In a seminal development for Wisconsin’s economy, manufacturing has begun returning home

Milwaukee Journal Sentinel

By Rick Barrett

June 12, 2024

This is part one of a five-part series.

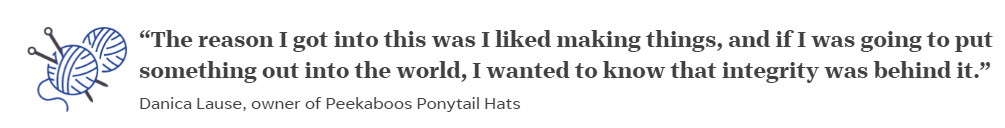

EVANSVILLE – Standing alone on the floor of the once-humming Stoughton Trailers factory, company president Bob Wahlin assessed his mothballed machinery.

Nearly all the lights were off in the 330,000-square-foot plant, located on the eastern edge of town, just off U.S. Highway 14 between Madison and Janesville. It was, Wahlin said, “pretty depressing.”

Then his iPhone flashed with a news alert.

A coalition of U.S. trailer manufacturers, including Stoughton, had prevailed in their complaint that Chinese companies were selling trailer chassis in the United States for below the actual cost of making them, a trade violation known as dumping, that unfairly harms competitors.

Soon, import tariffs of more than 200% would be levied on those Chinese trailers, which are used to haul ocean-cargo containers on American highways. Sales would swing back to the U.S. manufacturers, supporting thousands of jobs in Wisconsin, Michigan, Pennsylvania, New Jersey, Alabama and Texas.

Stoughton Trailers would hire hundreds of assemblers, welders and supervisors in Rock and Dane counties where the company, with nine centers including the one in Evansville, is a major employer and the nation’s fourth largest semitrailer manufacturer.

“This is a family-owned business. We live in the communities, we work here, and we’ve grown up with the people who work here,” Wahlin said.

The April 2021 ruling from the U.S. International Trade Commission became a seminal moment in a business trend called “reshoring,” which is the return of work from overseas to a company’s home country. The reasons could include trade wars and tariffs. In some cases, companies have moved production back after taking it overseas; in other cases — like Stoughton Trailers — they’ve resurrected it after crushing losses to foreign competitors.

“Stoughton Trailers is a great example of American grit and determination in the face of China’s economic warfare,” said then-U.S. Rep. Mike Gallagher, a Republican from Allouez, in northeast Wisconsin.

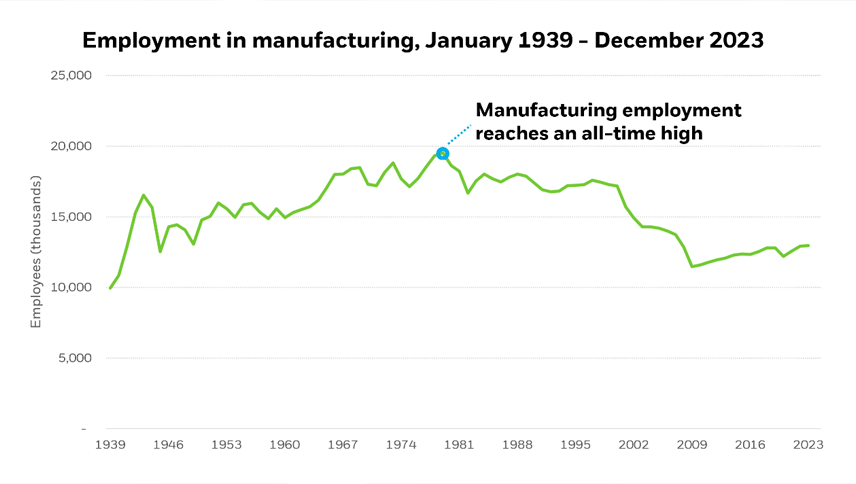

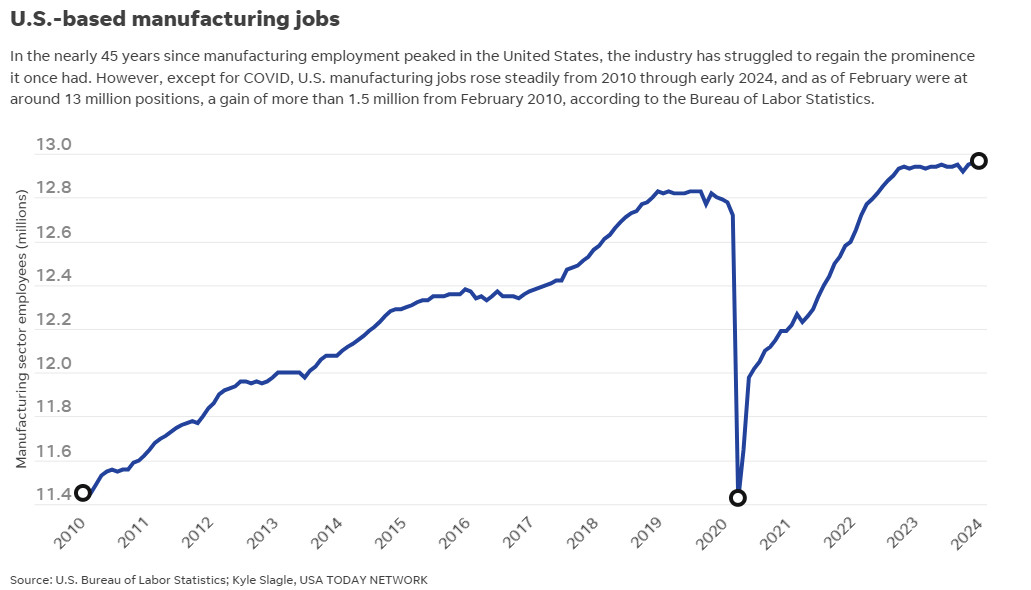

In the nearly 45 years since industrial employment peaked in the United States, manufacturers have struggled to regain their prominence. Now, they have some wind at their back.

With the exception of the COVID-19 period, U.S. manufacturing jobs have risen steadily from 2010 through early 2024. As of February, the manufacturing sector accounted for about 13 million American workers, a gain of more than 1.5 million from February 2010, according to the Bureau of Labor Statistics.

Much of the increase has come from less work leaving for China and more foreign investment coming into the United States. Over about the last two years, the U.S. has attracted 24% of global foreign direct investment, according to UBS Investment Research. During the pandemic, shortages of everything from appliances to automobiles exposed the fragility of global supply chains and sparked interest in making things closer to home.

Workers install the roof on a 53-foot dry van trailer at Stoughton Trailers in Stoughton. Mark Hoffman, Milwaukee Journal Sentinel

“The U.S. is now attracting capital at a rate not seen since the 1990s, prior to China joining the World Trade Organization,” UBS said last summer.

“Manufacturing is at a watershed moment in American history,” said Harry Moser, president and founder of the Reshoring Initiative, a nonprofit that promotes U.S. manufacturing.

It’s difficult to overstate the importance of the phenomenon to Wisconsin, where manufacturing and agriculture, especially food processing, are critical drivers of the economy. The state is second only to Indiana in the highest concentration of manufacturing employment, around 480,000 jobs, according to the U.S. Bureau of Labor Statistics.

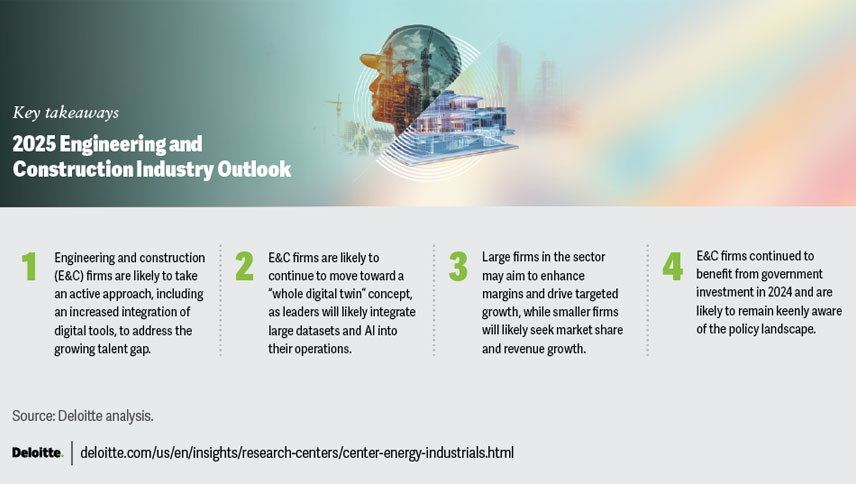

The government doesn’t track reshoring; however, business firms Deloitte, UBS, and Bank of America have followed the activity. Corporate reshoring announcements were up nearly 300% in late 2022 compared with three years earlier, according to a UBS analyst note in early 2023.

Kearney, a management consulting firm founded in Chicago nearly a century ago, weighed in with a 2023 survey of U.S. chief executive officers showing 96% were, at minimum, evaluating the potential to reshore.

“We finally seem to be heading toward a sustained reshoring movement,” said Omar Troncoso, a partner in the firm’s consumer and retail practice.

The key word is “sustained.” Manufacturers say one of their biggest worries is that a shortage of skilled workers threatens to undermine growth, and although they are loathe to engage in politics, they acknowledge that immigration has to be part of the solution.

Global supply chains worked in normal times. These are not normal times.

For decades, global manufacturing has been synonymous with low-cost countries and supply chains connecting continents. It worked well and was very profitable for many years, said William J. Holstein, an author and former editor-in-chief of Chief Executive magazine, aimed at business leaders.

The mantra of CEOs has been to manage their businesses, some of which have a majority of sales outside the United States, in a way that conforms with the regulations of each country where they operate. But they genuinely believed they had no special obligation to the United States or its national security, according to Holstein.

That philosophy “is now under assault,” he said. The pandemic revealed that global just-in-time supply chains weren’t reliable. Natural disasters and geopolitical conflicts have shown the systems are not always functional or secure.

Moreover, the world has become more unstable. Russia’s invasion of Ukraine and Israel’s war in Gaza have disrupted global trade, and rising tension in China about its economy and, particularly, its relationship with Taiwan, have raised the specter of severe upheaval.

Critically important products are at risk. China’s overwhelming control of the manufacturing of antibiotics, electric vehicle batteries and many electronics is troubling for the United States.

“American CEOs are in a historic jam at the moment,” Holstein said. “The ones who led us down this path of globalization are waking up and discovering the underlying philosophy has some trouble.”

On April 3, the strongest earthquake to hit Taiwan in 25 years rattled confidence in the supply of semiconductor microchips, essential for everything from home electronics to military weapons. Taiwan accounts for more than 60% of the microchip supplies worldwide, and 90% of the advanced chips used in smartphones and high-performance computing.

When the tremors began, Taiwan Semiconductor Manufacturing Company halted production and evacuated personnel from plants. The company later said its buildings weren’t damaged, but just those initial reports raised concerns with technology companies. The Taiwanese firm is the world’s largest chipmaker for customers like Apple, Qualcomm and Sony.

This photo taken by Taiwan’s Central News Agency (CNA) on April 3, 2024 shows a damaged building in Hualien, after a major earthquake hit Taiwan’s east. At least one person was feared dead and nearly 60 injured on April 3 by a powerful earthquake in Taiwan that damaged dozens of buildings and prompted tsunami warnings that extended to Japan and the Philippines before being lifted.

The deadly quake, estimated at a magnitude of 7.4, collapsed buildings and left others leaning precariously. Within hours, aftershocks rolled across the island. Had it struck elsewhere or more forcefully, the global impact on supply chains could have been felt for months.

Taiwan is located in the Pacific Ring of Fire, an area considerably prone to earthquakes and tsunamis.

The quake underscored the urgent need for the U.S. to reshore microchip manufacturing, said Peter Guinto, vice president of government affairs for Resilinc, a Milpitas, Calif., supply-chain services company.

“We don’t know where the next epicenter will be, but if it’s in a place where semiconductor manufacturing is prominent, it could potentially be very damaging for the supply chain,” Guinto said.

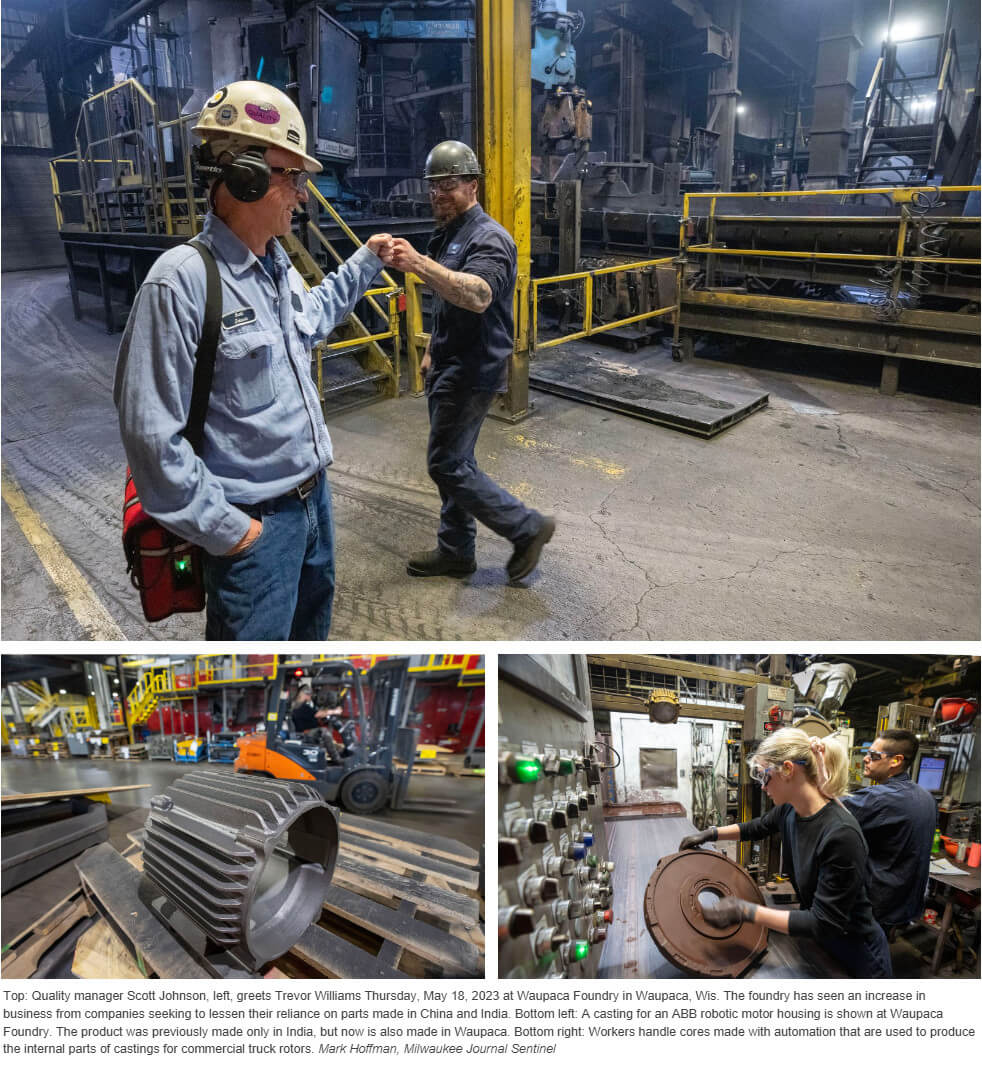

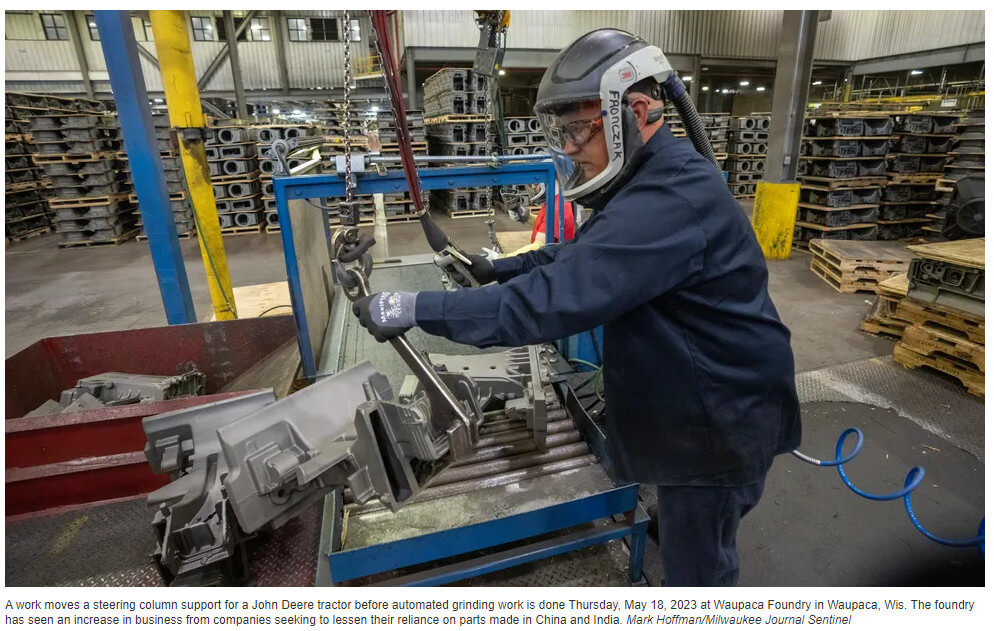

A worker handles chemically-bonded sand cores made that are used to produce the internal parts of castings for a commercial truck rotors Thursday, May 18, 2023 at Waupaca Foundry in Waupaca, Wis. The foundry has seen an increase in business from companies seeking to lessen their reliance on parts made in China and India.

Buckets, bikes, and dishwashers come home

At Waupaca Foundry, in central Wisconsin, a tractor bucket has come to symbolize the appeal of reshoring.

Wisconsin ranks fifth among states in the number of foundries. Waupaca Foundry is North America’s largest supplier of iron castings for products such as engines, brake rotors, and factory machines. It melts 9,500 tons of metal a day and has benefited from reshored work across various industries.

One of the company’s customers is Amerequip, a manufacturer of landscaping and agriculture equipment based in Kiel, a small northeast Wisconsin city once known for having a wooden shoes factory.

In 2020, Amerequip sought help from Waupaca in fabricating a backhoe bucket for a John Deere compact tractor. It had to be rugged and visually appealing to consumers, and Amerequip did not want it to use hard-to-obtain bucket teeth from China.

The two companies completed the task in 18 months. Their cast-iron bucket, now made in Wisconsin and Indiana, was the American Foundry Society’s 2022 Casting of the Year.

It “will inspire others,” one of the judges noted.

U.S. foundries have benefited from companies seeking reliable sources of metal-cast products, many also driven by high overseas shipping costs and worries about U.S.-China relations.

“It’s been a net positive for us the last several years,” said Alex Lawton, CEO of Lawton Standard, a 145-year-old foundry in De Pere. “For every part where someone has tried to save money on overseas, we’ve seen several parts come back.”

Yet some foundry operators remain wary of customers that left them for China years ago and now want to come back. Those customers would leave again, they fear, if the winds changed.

“I tell them we would require a seven-year commitment to keeping their work in the States, and for a portion of those people, that pretty much ended the conversation,” said Taylor Pearson, president of Washburn Iron Works in northern Wisconsin. “We’re not a Band-Aid to fix the mess they’ve put themselves in.”

Reshoring has been accompanied by other trends such as factory automation and the growth of foreign-owned companies. Expansions have come from companies like Milwaukee Tool, which is owned by Hong Kong-based Techtronic Industries, and GE Appliances, which is part of China-based Haier Group.

Milwaukee Tool said in May 2022 it would add 1,000 jobs over three years in southeast Wisconsin. The hiring would be part of a $206 million investment in power-tool technologies used in the skilled trades.

Less than a year earlier, in October 2021, GE Appliances announced a $450 million investment in Louisville, Kentucky, where it has the largest factory of its kind in the nation. Over five years, the company had already spent more than $1.3 billion on U.S. manufacturing and distribution operations, creating around 3,000 jobs, most of those in Kentucky.

Tariffs of up to 50% on foreign-made washing machines, imposed in 2018 and which expired in early 2023, boosted U.S. appliance making as GE and Korean manufacturers Samsung and LG opened or expanded plants in Kentucky, South Carolina and Tennessee. State tax credits provided a further assist.

“GE Appliances continues to bring manufacturing back to the United States, creating jobs and economic growth. We want zero distance between us and the millions of families across America we serve with our products,” Kevin Nolan, company president and CEO, said in a statement.

Proximity also was important for Guardian Bikes, which pulled its production out of China — a rarity given that children’s bicycles are nearly all made in Asia. The Austin, Texas, company says it’s now focused on assembling products at a highly automated plant it opened in 2022 in Seymour, Indiana.

The “status quo in kids’ bikes is broken,” said Guardian co-founder and CEO Brian Riley. “The pandemic exposed to the average consumer what experts already know — a China-dependent supply chain is fragile and unsustainable.”

Riley founded the company after witnessing a family member endure a painful recovery from an over-the-handlebar fall caused by over-applying the front brake. He set out to create a braking system that would prevent such accidents and found a market with parents seeking a safer, better bicycle for their children.

“There hasn’t been innovation in this space in decades,” Riley said.

Guardian’s sales have surpassed $33 million since it made a pitch for funding on the television show Shark Tank in 2017. That’s when billionaire Mark Cuban, an Indiana native, became one of its investors.

Reshoring has complemented manufacturing in some of Wisconsin’s legacy industries.

In 2018, Komatsu Mining closed a factory in China and brought the work to Milwaukee, where mining machines have been made for more than a century, and where the company already had a significant manufacturing presence.

A large electric mining shovel highlights the entryway at Komatsu during the opening ceremony for its new $285 million-dollar campus in Milwaukee’s Harbor District on East Greenfield Avenue in Milwaukee on Monday. Komatsu’s new headquarters include a 180,000-square-foot office building and a 430,000-square-foot manufacturing facility.

Komatsu builds some of the world’s largest mobile land machines. Its biggest mining shovel weighs nearly 4 million pounds and has a bucket the size of a two-car garage. In front of the company’s mining equipment headquarters in Milwaukee’s Harbor District, there’s a 60-foot-tall electric mining shovel and 850,000-pound truck on display.

The Chinese plant the company closed made gears and components for mining shovels used for excavating iron ore, copper, and other commodities. “We felt it was more important to be doing that work here,” said Komatsu Surface Mining President John Koetz.

Most of Komatsu’s mining trucks are made in Peoria, Illinois. But the company reshored some production of trucks, used for mining, construction and quarry work, from Japan to Chattanooga, Tennessee, where the work was previously done.

About 20 minutes from the factory there’s a Volkswagen plant that employs more than 5,500 people at an average annual salary of $60,000.

“We’re really starting to see a resurgence in manufacturing here,” said Walt Nichols, general manager of the Komatsu factory in Chattanooga.

Much of reshoring involves small businesses

While major manufacturers grab the most attention, much of the reshoring movement has been with smaller businesses.

As a student at University of Wisconsin-La Crosse, Danica Lause knitted hats by hand. One of them, by mistake, had a hole in the back that turned out to be useful for popping out a ponytail. It became the inspiration for her company, Peekaboos Ponytail Hats.

After college, Lause worked for a chemical company and traveled much of the week. She made hats in her east side Milwaukee apartment on weekends and knitted some on flights to California.

Danica Lause wears one of the hats she designed. Through automation and innovation, Lause has successfully moved all of her Peekaboos Ponytail Hats production from China to Germantown. Her hats are designed with holes for ponytails.

As sales grew, Lause needed a manufacturer. But affordable help wasn’t available to mass produce hand-knitted hats in the U.S., and there wasn’t yet a machine capable of handling the Peekaboos design.

Lause tried using knitters in South America and Europe, but it didn’t work out. She finally found people to make the hats in China, and that lasted about three years.

The quality, however, was inconsistent. Hats would vary in size, and some weren’t good enough to ship to customers. Lause said she couldn’t be certain the knitters in China received a fair wage and were treated well by the contractor she used. That made her uncomfortable.

“They would send me photos and videos, but it never really felt right,” she said.

Lause sought to gain more control over production.

“The reason I got into this was I liked making things, and if I was going to put something out into the world, I wanted to know that integrity was behind it,” she said.

Lause was told again and again that the process was too difficult to automate. Instead of giving up, she and an engineer from a knitting-machine company in New Jersey spent nearly two years searching for a solution. The one-ton 3-D knitting machine and software they developed cost $80,000 and could handle the hats’ patented ponytail feature as if it was knitted by hand.

Now, Lause, a self-described “recovering perfectionist,” has three of the machines in a Germantown shop where she and a handful of employees produce the hats sold on the company’s website.

“I felt like the luckiest girl for being able to have this in my four walls, to make this product at the level of integrity I wanted and needed,” she said.

For Wisconsin housewares company, a mix of sources works

Other, larger companies, have found a hybrid model of reshoring works for them — bringing some products home, leaving some abroad.

Around 20 years ago, Metal Ware Corp., the Wisconsin-based maker of the legendary Nesco Roaster and other household goods, closed its factory in Algoma and moved the work to China.

Many companies across the state and nation went down a similar path. With low-cost labor and subsidized industries, China seemed unstoppable in its quest to become the factory of the world. Manufacturers in the U.S. were at a huge disadvantage, Metal Ware owner Wes Drumm told the Milwaukee Journal Sentinel in 2003.

For cost reasons, the Nesco Roaster continues to be made in China. However, century-old Metal Ware has returned other manufacturing to northeast Wisconsin.

Injection press operator Yang Xiong stacks NESCO food and jerky dehydrators Tuesday, August 23, 2022 at The Metal Ware Corp. in Two Rivers, Wis. The appliance uses electrical parts made in China that are assembled and mated with parts made in Two Rivers. The privately held company, which became famous for its NESCO roasters that are now made in China, has been shifting some manufacturing of other products back to the city on Lake Michigan.

“We’re probably the main company around here that’s reshored. It feels extremely good because I grew up in this community…went away for years, and when I first came back, everything had left,” said CEO Rick Carey.

The question now is to what degree consumers are willing to pay for made-in-America goods.

The Boy Scouts of America dropped Metal Ware as the manufacturer of its camping cookware kit and instead sent the work to China. Metal Ware made the kit for many years and said it never had a complaint.

“I was absolutely flabbergasted,” Carey said. “If the Boy Scouts of America don’t assign the value to an American-made product, how can we expect any consumer to?”

China is still the factory of the world. But this is an opening.

With all the reshoring taking place with U.S. companies large and small, China is still considered the factory of the world — a title it’s not likely to relinquish. And some U.S. companies are still moving work there, or at the least, aren’t pulling it back.

However, U.S. new investment in China during the first half of 2023 was down 31% from 2022, according to Grace Wang, an economics professor at Marquette University. Also, China has lost work to Vietnam, Thailand, Mexico, and other low-cost countries.

Chinese manufacturers face significant new challenges, including rising wages.

“In 2023, the average manufacturing wage in China was more than three times that in Vietnam. These wage differentials suggest China is gradually losing its competitive advantage in industries that rely on labor-intensive processes, such as household items or sporting goods. As a result, countries like Vietnam are becoming more attractive for foreign investment in such industries,” Wang said.

Stacked and completed intermodal container chassis trailers are prepped for pick up Tuesday, April 25, 2023 at Stoughton Trailers in Stoughton, Wis. A Chinese competitor of Stoughton Trailers illegally flooded the United States with products at below-market prices, for less than what Stoughton paid for the raw materials. In 2021, Stoughton and its American peers prevailed in their trade dispute with China when the federal government cleared the way for more than 220% in import duties on Chinese-made trailers.

Just as Americans struggled when factories left their communities years ago, many young people in China cannot find work.

“Given the labor market situation, factory closures can have quite a negative impact on workers. The loss of income is, of course, the most visible impact. However, the result of factory shutdowns can be more profound, especially in an environment with a relatively high unemployment rate,” Wang said.

Reshoring could be enduring if the economics allow for it, but that’s far from certain.

Past attempts failed in favor of global trade and competitive advantages, UBS Investment Research said in its 2023 Made in America report. “Any potential resurgence of American manufacturing will take years and face labor constraints, alongside other challenges such as the often-lengthy process of regulatory review.”

Nationwide, a skills gap is a threat to reshoring. Unabated, it’s expected to leave around 1.9 million jobs unfilled by 2033, according to Deloitte Consulting and The Manufacturing Institute.

The largest barrier to having a stronger workforce is recruiting enough trainees.

A “massive shift” in resources is needed from liberal arts college degrees to engineering and apprentice programs, says Moser with Reshoring Initiative. “Aggressive action is needed now to increase the quantity and productivity of our workforce,” he said.

Stoughton Trailers, again, will be a company to watch. In Evansville, it produced a steady stream of intermodal trailer chassis until the early 2000s when Chinese manufacturers entered the market, said Wahlin, the company president.

“That part of our business went down to zero,” he said, adding the Evansville plant was closed for several years until it could start making other products. “The chassis line was shut down and a bunch of equipment was collecting dust in a dark factory. It was heartbreaking for the business and the community. A lot of people lost their jobs.”

Ultimately, three Chinese companies controlled more than 86% of the world’s supply of intermodal chassis, and those same companies built more than 95% of the containers those trailers hauled, according to a report from U.S. Federal Maritime Commissioner Carl Bentzel in 2020.

One Chinese manufacturer in particular was selling heavily subsidized trailers for less than the cost of the steel in the frame, the coalition of U.S. companies claimed in their trade violation complaint. “Our primary foreign competitor has long been one of China’s prized state-owned enterprises,” Wahlin said.

The Chinese manufacturers — and, notably, some in the U.S. transportation industry — viewed the dispute much differently. They said coalition members had only themselves to blame for not responding to changes in the marketplace, and for not investing in new designs and factory automation.

Some U.S. freight handlers said the Chinese were a more reliable source of intermodal chassis.

“When our members try to purchase chassis from the (five U.S.) companies, they often fail to deliver,” the Harbor Trucking Association said in a U.S. International Trade Commission hearing.

Track Intermodal, based in Princeton, New Jersey, agreed.

“We do not import chassis from China and elsewhere because they are cheaper as a result of dumping or subsidies. We import because we have to. We have no choice,” testified Val Thomas Noel, the company’s chief operating officer.

Some have argued that the cost of the tariffs, in higher chassis prices, will eventually be borne by American consumers in higher prices for products that travel by truck, which is nearly everything. The countervailing duty and anti-dumping order, plus another tariff already in place, more than tripled the price of a $12,000 Chinese chassis.

Workers finish constructing an intermodal container chassis trailer Tuesday, April 25, 2023 at Stoughton Trailers in Stoughton, Wis. A Chinese competitor of Stoughton Trailers illegally flooded the United States with products at below-market prices, for less than what Stoughton paid for the raw materials. In 2021, Stoughton and its American peers prevailed in their trade dispute with China when the federal government cleared the way for more than 220% in import duties on Chinese-made trailers.

After the ruling, Stoughton Trailers grabbed market share and ramped up production. So many new hires were needed, it recruited hundreds of people from Colombia, Nicaragua, Mexico, and Puerto Rico for jobs with a starting wage of around $20 an hour.

The company, now with more than 1,600 employees, opened a factory in Waco, Texas, and is building a new headquarters on the corner of Highway 51 and County Road B in the City of Stoughton, replacing the headquarters it’s had in an old industrial building since 1966.

The trade-dispute ruling is subject to review in 2026, at which time the tariffs on Chinese-made trailers could be dismissed.

“We have this time to rebuild that business,” Wahlin said. “It’s our responsibility to be sure we’re ready to compete globally.”

Source: https://www.jsonline.com/story/news/2024/04/24/manufacturing-companies-are-bringing-work-back-to-the-u-s-from-asia/71931591007/