How to Perfect Land and Expand

Kyle Duffy Partner, Gradient Ventures

May 16, 2024

Mark Roberge: Hey folks, welcome to another episode of The Science of Scaling, a show about how to scale your revenue and sales. I’m your host, Mark Roberge. Today we’re doing something a little different. We’re talking to Kyle Duffy, someone that I have a lot in common with. He’s a former go to market operator with a bunch of great companies.

And now he’s on the investor side. He’s over at a firm called Gradient Ventures, which if you don’t know them, they’re part of Alphabet, the parent company to Google, and they specialize in early stage investing in AI and machine learning. Exciting stuff. So we’re going to unpack Kyle’s perspective on the early stages of go to market development across the portfolio companies he works with.

What is the biggest opportunity that he sees? That early stage founders and companies don’t exploit. Let’s find out.

This is a fun one for me because you and I have been spending the last few years looking at the startup ecosystem through a very similar lens, not just as a venture capitalists, but as venture capitalists that help early stage portfolio companies. With their go to market strategy. Uh, you and you were specifically around AI and us a little more broadly at stage two capital and just B2B software.

What is like the biggest opportunity that you see startups not lean into as much as they should at that very early stage? That’s a big one.

Kyle Duffy: So for go to market, something that gets overlooked, you know, from the beginning, they see it as, okay, we need, we need revenue. We need customers in the door. I don’t think there’s enough focus spent on customer success and specifically around that, how to expand customers that you already have.

Mark Roberge: Hey folks, this is Mark here. Bingo. Yes. All of these founders and sales teams are. obsessed early with new customer acquisition, with revenue growth. And I know why. That’s the first question that everyone asks. Where’s your revenue at? No one’s like, Hey, that sounds like a cool business. What’s your retention?

But kudos to Kyle, that that is the perfect orientation in the first phase of the business. Would you rather have a business that’s tripling in revenue, but has a leaky bucket? And half of them leave or a business that’s growing steady at 30 percent a year and everybody loves the product and everybody sticks around and everybody expands.

The latter might sound less sexy, but it’s a far better foundation upon which to build a company. All right, let’s get back to Kyle.

Kyle Duffy: I mean, we both know it’s easier to. Expand a happy customer than to land a new customer, you know, and I’ve been thinking about this with our companies a lot and specifically our founders, like how from the beginning do we set the stage for a good land to expand motion?

Mark Roberge: Love it. We’ve got this obsession with the new customers, but you want to orient them around the land and expand with the expand in capital E. Why do you think founders don’t lean into that as much as they should? I don’t know if they’re

Kyle Duffy: seeing the opportunity. Um, at least in our portfolio, you know, we’re working with a lot of founders and even early stage sales leaders who haven’t necessarily had the customer focus in the past.

They’re just focused on getting new logos in the door versus the opportunity to expand. And I think from a sales leader perspective, perspective. Once a company has hired a sales leader, it’s more about like, how do we get the biggest deal possible right from the start? What I’m seeing, and especially in 2023, where procurement cycles have lengthened, and we could talk about that, it’s easier to get in the door with either a sliver of your product set that’s maybe less risky for the customer, or into a group, one specific team at maybe a larger enterprise to prove out the model before going bigger within an account.

Mark Roberge: Makes sense. And does this apply in all entrepreneurial settings or are there some where that it’s a better application than others? I think

Kyle Duffy: probably the most applicable is it’s a company that has something to expand. So, um, either you’re, you know, you’ve got a product solution that, you know, you can, you can sell part of it to begin with, and then you can, um, you know, upsell in the future, you know, another part of the product, or it’s a product that applies to a number of different teams within an organization.

Mark Roberge: This is crazy actually hearing Kyle right now, because literally two months ago, we made an investment at Stage 2 Capital and we’re having a debate about land and expand. I really want them to do it. And I wrote this sentence in their go to market assessment, land and expand motions are becoming more common in SaaS and are preferred generally by most customers.

Especially for large transformative technologies. It’s unclear if you have this context. However, here are the strategies to mitigate the negatives of the land and expand model by choosing the land product modules that fit the following four criteria. Number one, enable low time and effort to retainable value.

Number two, align with the currently perceived versus evangelized customer need. Number three, Provide a strategic wedge for further platform adoption. And number four, develop high switching costs once implemented. So if you’re thinking about land and expand and you’re evaluating options, think about that lens as a way to pick the optimal approach.

Let’s get back to Kyle. So you can start with one team

Kyle Duffy: and

Mark Roberge: you can expand it to others. All right. So let’s talk about if I’m listening and I’m a founder, I’m like, Oh my gosh, you know, Kyle’s totally right. I’m banging on the door here. Try to. Move through these nine to 12 month sales cycles to sell my big product vision.

And if I could just do a more of a land and expand motion, this will accelerate everything for me. What are some of the foundational steps that a founder needs to pay attention to, to make sure they’ve set their organization up for success with land and expand,

Kyle Duffy: I think first is setting the foundation in terms of who you’re selling to within the org, you know, and being very specific around your, your persona that you’re selling to thinking that, okay, we can get in the door.

What’s our wedge. So what’s going to be the least friction to get in the door to a customer, making sure that everyone is aligned around. The foundation of the persona and the ICP that you’re selling to next up in sending the reps. So it’s okay that they sell that 25k deal versus a six figure deal to get in the door and that their comp structure is set up in such a way that they’re going to be motivated down the road to grow that business, making sure that the, the AE.

Is comped not just on new business in the door, but also business coming from existing customers. That doesn’t mean they get comped on a renewal. So if they close the 25, 000 deal to begin with, you know, and it renews a year from now at 50, 000. Okay. So you might not get comped on that initial 25 K.

However, you do get comped in that net new 25k expansion.

Mark Roberge: Now, I love that. I’ve used that very successfully and it gives me like conviction. I’ve also been in board meetings where I’ve had pushback from other VCs like, Hey, AEs should close. Let’s not waste their time on, you know, renewals and expansion.

Let’s these are hunters. Let’s make them hunt. How do you deal with that conflict at sort of the board and strategic level?

Kyle Duffy: I don’t think it’s a waste of time. It’s revenue and it’s good revenue. You know, and that, that expansion revenue, I will guarantee the CAC is lower on that, the cost to acquire that revenue is lower than a net new customer.

Mark Roberge: All right. So those are great foundational steps, Kyle. What about common potholes you see where, you know, you walk into an early stage startup and you’re like, wow. You set this up to really hurt your ability to do land and expand successfully.

Kyle Duffy: So the best companies I see do this. You’ve got a customer obsessed founder and beyond the customer obsessed founder, you’ve got a customer obsessed sales leader.

And a customer obsessed, whoever is leading customer success at that point, you know, so I think across the board, you have to be focused on the customer. Um, and I actually didn’t mention product as well. So product has to be thinking about the customer to begin with, because you need to be creating. And I used to say this to my last customer success team.

My, at my last startup is. At the early stage, we’re not just creating customers. We’re creating raving fans of our product. I usually say for, for founders anyway, at the early stage, you should be having 10 to 12 customer conversations per week. And if you’re not, there’s, there’s something wrong. You know, some VCs will say, you know, don’t offer services.

You know, we don’t want services revenue, you know, where I would, I would. You know, push back on that for at least some, some types of products that require some level of services to get a customer to be successful. And, you know, we did some data mining at my last company to show that customers who churned ultimately it was because they would never onboard it correctly.

That’s probably the number one reason that we could point to for customers churning or not expanding is a customer has to see value in the product and to see value in the product, they have to be onboarded correctly and they have to have operationalized product successfully.

Mark Roberge: Hey folks, just Mark here.

I agree with Kyle. This 20 years is we went through a interesting entrepreneurial journey in sort of the mid nineties, late nineties, early two thousands, where. We confused services businesses with scalable software businesses and a lot of investors and entrepreneurs got a little screwed over because, you know, services revenue is valued usually around one X and good software revenue is valued at say 10 X.

You have a 10, 000, 000 services business worth 10, 000, 000. You have a 10, 000, 000 software business worth 100, 000, 000 because it’s more scalable. And so because of that, we swung too far. We have a lot of businesses where 98 percent of their revenue. Is software and only 2 percent of services. But what people aren’t looking at is if we just loosen that up a little bit and maybe went to say 90 percent software and 10 percent services.

The impact on customer attention is enormous, and it’s okay that that 10 percent is only valued at 1x, and our software is, the 90 percent is valued at 10x, because the, the increase in the services revenue we’re taking on. Is making those customers to stick. So I like Kyle’s perspective here. And let’s not swing too far on the software to services revenue ratio.

Let’s get back to Kyle.

Kyle Duffy: And especially when it comes to enterprise products that are more complex, to offer some level of services, it’s not necessarily a bad thing. That’s great. And now,

Mark Roberge: um, you talked a little bit about the team, but I’m curious about the transition. So let’s just imagine that The founders are probably doing some level of selling, onboarding, renewing, expanding initially.

Whether it’s the first two customers, the first 20 customers, the first 200 customers, whatever. And at some point they’re like, okay, I need to like delegate this. Let’s fast forward to having this cross functional team. But at some point you start to have a team. Three or four AEs, two or three CS folks.

And you still want to preserve this land and expand. What happens at that point? Because I’ve seen folks do it well in the beginning and then once they build the team, they lose it. Why does that happen? And how do you prevent it?

Kyle Duffy: I think one reason why they lose the momentum is that at the early stage, there’s such alignment because you might have two reps and one customer success manager.

And they all sit together and they’re super well aligned. I think over time you can lose some of that alignment and it be in silos can be created between the teams. So I really do my best to, to remove silos. I think there’s a couple of things that you could do. Um, I see the companies that are co located at this point.

So you’ve got, you know, you go to market team all sitting together, really valuable. Not always possible in today’s remote world. I get it. Um, secondly, I think if you can align, you know, you could see kind of pod structures work well where for, you know, especially if it’s a bigger accounts where you’ve got more of an ABM strategy.

Mark Roberge: Hey folks, just Mark here. My colleagues are laughing. The fact that Kyle just said pods. Pods is a little bit of my pet rock. I love pods when it comes to this type of issue of alignment. Especially with sales and customer success. Because I see a lot of teams where as you scale, the sales team is on this floor of the office and the CS team is on this floor of the office.

And it gets to a point where it’s like the salesperson closes a customer, they hit submit in the CRM, and then it’s assigned to a CSM and they don’t even know each other. They don’t even talk about it. The only time the salesperson finds out which CSM got their account is when the account churns and they get their commission clawed back and they’re pissed.

But instead, if you create pods and you physically sit these people together, or even if you’re working remotely, have most of the customers from these two salespeople. Go to these two CSMs most of them and now they’re like they’re talking a lot, you know, hey Matthew That customer you signed up two weeks ago.

They’ve blown off two onboarding calls now. Oh, really? That’s a shame Let me go back and talk to them, you know, I like and Matthew the CSM sees Mark Struggling on the last day of the quarter and there’s a questionable customer and he’s like, you know what? Let me talk to them I bet we can take them on I know you’ve been working your butt off and you’re trying to hit the quarter You And so you get that relationship that you can’t devise through the CRM process and the data and the structure that actually happens.

And clearly Kyle has benefited from that, as has I in in much of the portfolio companies. All right, let’s get back to Kyle

Kyle Duffy: So you’ve got a set of accounts. You’ve got sales and customer success managers all lined around those particular accounts versus kind of more haphazard territories can be valuable.

And then lastly, I think the incentive structure is really crucial. So it’s like a debate. Going back to the beginning of customer success time, in terms of who owns that expansion revenue, does, does the AE own it? Does the customer success manager own it? I’ve seen it work both ways. I have my personal bias to say that the account executive is going to own any net new expansion revenue.

And the reason for that is to keep customer success as a trusted advisor for the customer. Really what we need to train the customer success manager to do is look for opportunities for expansion within the account. So they should be constantly looking, listening for those expansion opportunities and knowing when to pull in that account exec.

And then the account exec is doing the selling in terms of the upsell or the cross sell and talking commercials with the customer. And they get comped ultimately on the commission for the net new expansion.

Mark Roberge: Does pricing come into play? Are there pricing decisions that you can make that will help land and expand versus hurt land and expand?

Kyle Duffy: Something with land and expand that I think is valuable that we didn’t hit on earlier is that I think you can really hold a customer to the value of the product. Meaning, if you get them in the door, they’re experiencing your product. They’re having a great experience. They’re less likely to push back on price when you go and ask them to roll out the product to a new team, because they already see that value.

From an initial pricing perspective, I think just making sure that you leave room for expansion down the road.

Mark Roberge: Yeah, I, I like what Kyle’s talking about here. Pricing is an important ingredient of this strategy. Yeah. Absolutely. And it kind of gets back to what we were talking about earlier of the pothole to over obsess with the opening ACV, annual contract value of the customer.

Because yeah, that accelerates short term revenue. And yeah, it demonstrates to the market that the willingness to pay for your awesome product is really high. But in addition to creating a churn risk and uh, an ankle biter risk, you have no room to expand. So many SAS businesses. get to the end of a year long contract with a customer, and the customer has used less than 50 percent of what they bought.

That is a very challenging customer attention conversation. That is a next to impossible customer expansion conversation. And so if you can keep You’re opening price low and that allows you to keep the value the customer is actually perceiving today in line with what they’re paying for. And that leaves opportunity for expansion and great net dollar retention and growth simply through your install base.

You don’t have to sell any new customers. And you’re still growing by 30 to 40 percent a year. All right, let’s get back to Kyle.

Kyle Duffy: So whatever variable you’re pricing off of, whether it be seats or API calls, you know, if it’s consumption or if it’s seat based subscription model, I think just making sure that you leave room for expansion.

And not give away the farm. If you’re only selling a part of your product to begin with

Advertise: talking too loud, hosted by Chris Savage is brought to you by the HubSpot podcast network, the audio destination for business professionals on this podcast, Chris Savage, Wistia CEO, and. Loudest talker takes you inside the minds of entrepreneurs as they share the hilarious, informative, and most challenging aspects of building more human brands.

You can hear episodes like building a reusable notebook empire with entrepreneur Joe Lemay or the AI video revolution with Wistia’s own head of production, Chris Levine. Listen to talking too loud, wherever you get your podcasts.

Mark Roberge: This is great, Kyle. I want to switch gears because. You’re probably in the 0. 001 percent of people in the world that have a experienced take on this. So I’m curious about any patterns you’re seeing on unique challenges, best practices, nuances of bringing AI tech to market. That we maybe don’t, is different than SAS and software and other, you know, products that we have more experience with.

Kyle Duffy: And you mean companies that are selling an AI product to their customer, right? Yeah. You’ve got a

Mark Roberge: bunch of companies that are building AI products and now they’re trying to bring them to market. Is there anything unique you’re seeing in the marketing, the sales, the customer success motion? That we hadn’t seen as much in say, like technology and software ecosystem.

Kyle Duffy: Yeah. So we’ve got a number of companies that I would consider like verticalized AI applications. You know, selling into say retail or legal. And oftentimes these industries, they’re more legacy industries. I think there’s excitement and there’s also hesitation about AI and the excitement makes it easier to get in the door upfront.

So these AI companies in terms of getting meetings, they’re doing quite well. So here, here’s the new, here’s where the nuance happens though, and where it’s different. Is that, okay, they’re in the door and they’re having customer conversations, but there’s more hesitancy on the part of the customer to actually roll out AI because they don’t quite know where to start.

And especially the bigger enterprises are really scared about the, the data security and compliance piece.

Mark Roberge: I’ve been studying this pretty closely, just, you know, Similar to Kyle, like what’s different about bringing AI to market. And there are tremendous parallels to the cloud in the late nineties. And it couldn’t be a better time.

I think this is always true, but right now it’s critical. If you’re bringing AI to market, design big, start small. It’s another way of what Kyle’s talking about with the opening land. If I can, I’ll jump to a B2C. Pretty famous example, in 1996, when a guy named Jeff Bezos quit his quant hedge fund job to start an e commerce company.

And he didn’t set out to start a bookstore. He quit that job because he knew that the way that all products, from groceries to furniture to clothing to books, were made in the United States. Would be changed in the next decade, but he didn’t start there. He knew that we weren’t ready to buy something, most things that we couldn’t touch.

And so he created a list of 50 products and said which one would be the best to start with. And he chose books because we know what a book is. We don’t have to touch a book to know there’s millions of unique titles. The gross margin is actually pretty good. And not only did it build the foundation for one of the most valuable companies in the world, but it also allowed him to build the operational moat of these decentralized delivery Infrastructure for him to capture the bigger game.

And that’s kind of what Kyle’s getting at here. We have the big vision, but we can’t sell it out of the gate. Cause we’re not ready. So sell the thing we’re ready for and hope that it builds the moat for us to capture the big vision as well. All right, let’s get back to Kyle.

Kyle Duffy: So I see AI companies getting held up in procurement cycles a lot longer than a typical SAS product would.

Mark Roberge: And what are the best. AI companies in terms of like the best go to market function doing to get ahead of the average and, and overcoming these obstacles.

Kyle Duffy: So say it’s a big enterprise and there’s a number of different applications they could use AI for. Let’s start with the application. That’s less risky.

So let’s get in the door there and less risky might be, it doesn’t like completely overhaul their operations. They don’t have to let people go. And maybe it’s using a data set that’s less proprietary than say, like something that’s really in their secret sauce. So let’s get in the door with that kind of frictionless application and then let’s expand from there.

Yeah, let’s get the trust.

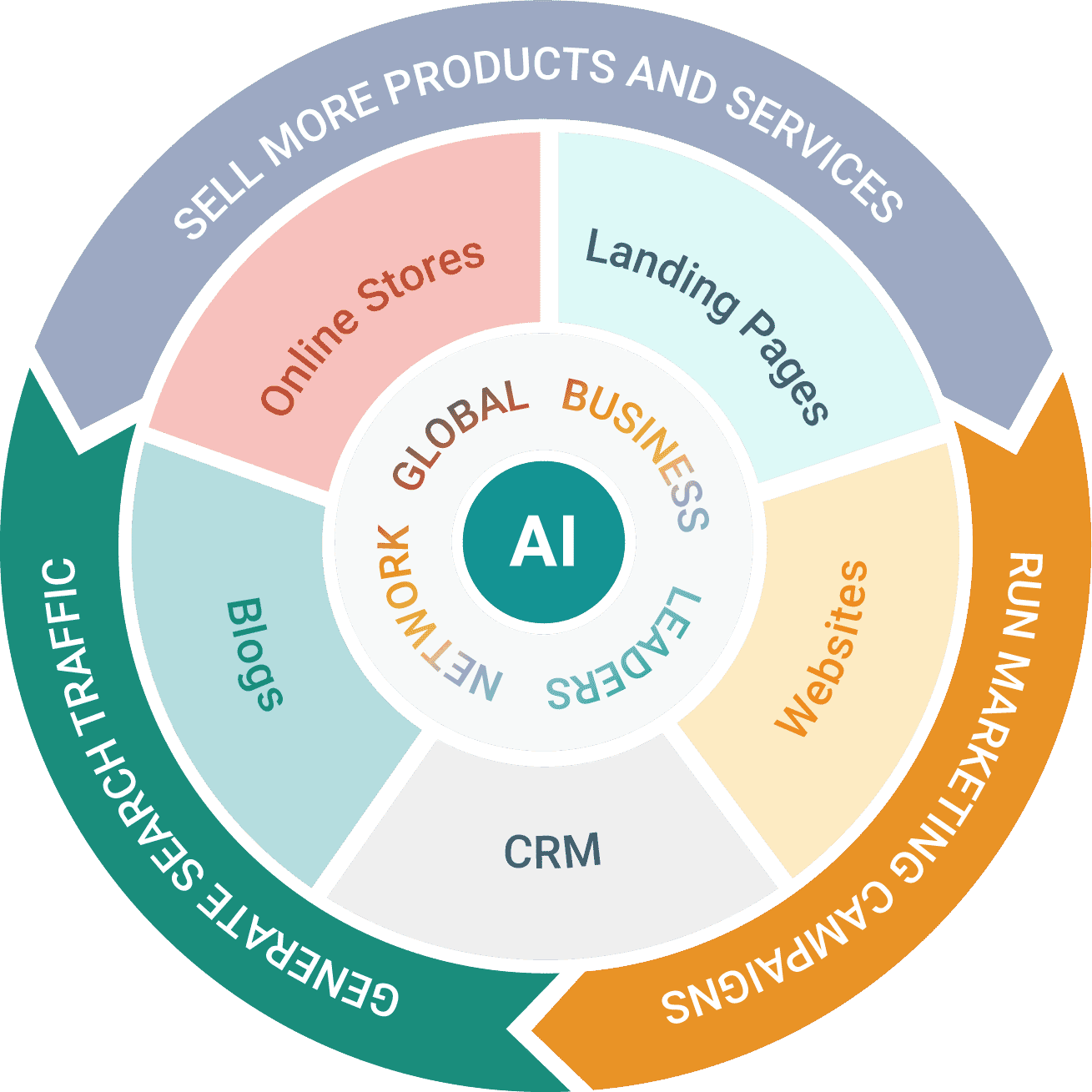

Mark Roberge: All right. And then the other opportunity I have to take advantage of here, Kyle, given the overlap of go to market expertise and AI expertise is the application of AI to go to market. Have you been exploring this with your portfolio? Have you seen interesting implementations?

What, what is this going to look like in a few years? Can you comment on that?

Kyle Duffy: It’s something I’ve thought about a lot and we’ve been researching and I’m seeing some companies using AI. It’s a matter of how do we, Best use it. So AI is a tool and I believe it’s, you know, human in the loop plus AI. It’s going to be a one plus one equals three.

It’s a matter of where we apply that. So generally the way I’m looking at it is through the sales cycle, because you could apply AI in a number of different areas. So I’ll just give, maybe I’ll give a couple of examples if that’s okay. So what I’d consider building the sales foundation in terms of like.

Who’s our customer? What’s our TAM look like? Determine who the persona is. So, there is areas where you can use AI, especially in terms of like, Analysis of the market that that gets interesting and then kind of once you determine those things. Okay, here’s my ICP. Here’s who we’re going after. Like, then I look at, you know, top of funnel and prospecting.

So I think again here, analyzing the market to understand, like, how do I get a list together of our of our, uh, My most relevant customers right now are my most relevant prospects. And then how do I personalize messaging to

Mark Roberge: them here? Yeah, we’re, we’re flowing pretty far beyond the expand topic, but I’m loving this because I’m seeing the same stuff as Kyle, you know, it’s like, we’re in that first wave of.

Which many would argue is a hype, you know, like, uh, like I mentioned, uh, AOL, Netscape, AltaVista, they were the winners early and they’re not the winners today. So what do we have today? Is it the first wave hype or are these the true winners? I don’t know. I do have an opinion that as you go across these specific use cases and go to market that Kyle’s talking about, I’d be more bullish on the use cases where the incumbents do not have the data.

The incumbents have the data to do AI forecasting. The incumbents have the data to do SDR copilots. The incumbents don’t really have the data to do I can’t think of a multi billion dollar company that has a billion hours of sales managers coaching their reps and attaches that to the performance data.

So that could be a good example. Anyway, let’s get back to Kyle.

Kyle Duffy: So there’s a lot of A. I. that. We’ll go out and comb a customer website and be able to pull in relevant information to build a message prospects better. There’s a lot of enrichment of data that can be used. Um, even when it comes down to narrowing contacts, like a LinkedIn sales navigator, you know, they’ve now got a chat bot that I found really interesting in terms of filtering lists.

Like it’s, it’s helpful. Um, as you get into deal cycles. You know, the, the deal intelligence. So, you know, we, we know A’s don’t like inputting data into a CRM. Ideally with AI, they shouldn’t have to do much of it. So all the data is in there and then AI helps make sense of, you know, where the deal is at and what the next steps are on a deal, and then it goes to coaching reps, how does a, You know, how does a VP of sales and coach their reps in terms of, you know, what’s happening in a deal.

Um, and then it goes to the post sale and similar with customer success. You’ve got all these inputs coming in, you know, we know all the conversations that you’ve had and this is where AI is really powerful in terms of okay. Let’s analyze all these customer conversations. Let’s analyze the customer data how they’re using The, the application, the solution, and let’s put together health tracking and next steps for how we best manage these customers.

Mark Roberge: A lot of these use cases, they, as we talked about earlier, seem to be a little more like features point solutions, opportunities that it wouldn’t be that hard for the existing incumbent platforms to capture. Does that mean that the entrepreneurial opportunities are limited? Or is AI a bigger opportunity than I’m hearing you say

Kyle Duffy: for

Mark Roberge: founders?

Kyle Duffy: I think with this opportunity, it goes to, you know, if you’re ha if you have too many point solutions and I feel this way today about the sales tech stack, generally there’s too many point solutions layered on. So I think if you can over time create the platform and I think, you know, the existing platforms, what they have is the reach and they have the audience.

So, you know, if you layer on some of these AI applications to that, it’s hugely powerful that said, I think a lot of innovation is going to come from startups. And, you know, a startup might be creating, you know, like we’ve seen a lot of startups that are creating like the virtual AI SDR or, you know, more personalized messaging.

Well, you know, that might work as a point solution. It’s probably better, though, integrated in with an existing CRM. So I think we’re going to see a lot of acquisitions in the space where maybe the innovations coming from startups. But given that existing platforms have the reach, they’re probably going to be acquiring some of this technology.

Mark Roberge: Will we get to a world where buyer AI bots are buying from seller AI bots? That’s

Kyle Duffy: very futuristic. I like that mark. Um, is it possible? Maybe, maybe I’ve, I think I’ve thought about more on the sell side. I don’t know if I can answer that about the buy side. I think the sell side though, for kind of turnkey solutions, AI is going to help a lot.

You know, those products that are more, they’re kind of self service, but it’s might be some sales assist right now, answering some quick questions. You know, it’s a 5k ACV. I think those will likely be serviced by AI bots in the not too distant future.

Mark Roberge: This has been quite enlightening, Kyle. As I mentioned, I, Really love it when I get to talk with someone that I haven’t spoken with much, but we’ve spent the last couple of years exploring the corners of the entrepreneurial ecosystem in a very similar way.

So it’s been a great pleasure to exchange notes and learn and grow in conviction on some of the patterns. That I’ve been seeing as well. Thank you for coming on and dropping knowledge count.

Kyle Duffy: Hey, super fun, Mark. Thanks man.

Mark Roberge: All right. That does it for me, folks. I’d like to thank our show runner, Matthew Brown editing support comes from pizza shark productions. Of course, I want to thank HubSpot for startups and the HubSpot podcast network for keeping the audio on. And by the way. I’m a huge fan of feedback, and so get this, if you’re listening on Spotify right now, check your phone, see that Q& A field, that’s a direct line to me and our show, so let us know what you think.

Alright, I’ll see you next week.

Source: https://youtu.be/SDfR6RhWhok?list=PLxEk_-9hb_F9UpZHfacUr9N3YbjnuKabX