Innovation-Led Industrial Policy For US Manufacturing

Forbes

By Dale Fickett

Mar 15, 2024

The pandemic highlighted issues surrounding supply chain resiliency, or the ability of a series of producers and logistics firms to withstand exogenous shocks (e.g., armed conflict, natural disaster). The challenges included panic buying and hoarding, factory closures, shortages of materials and labor, shipping delays and trade protectionism. Consider the difficulty in finding cleaning supplies, personal protective equipment and baby formula.

Business leaders and policymakers are clarifying an array of U.S.-based manufacturing opportunities. Cost comparisons have increasingly favored local manufacturing when factoring automation, labor cost comparisons, government incentives and transportation costs. This is impacting an array of industries: defense and aerospace, automotive, electronics, machinery, chemicals, food and beverage, textiles, metals, plastics and rubber, and wood and paper products.

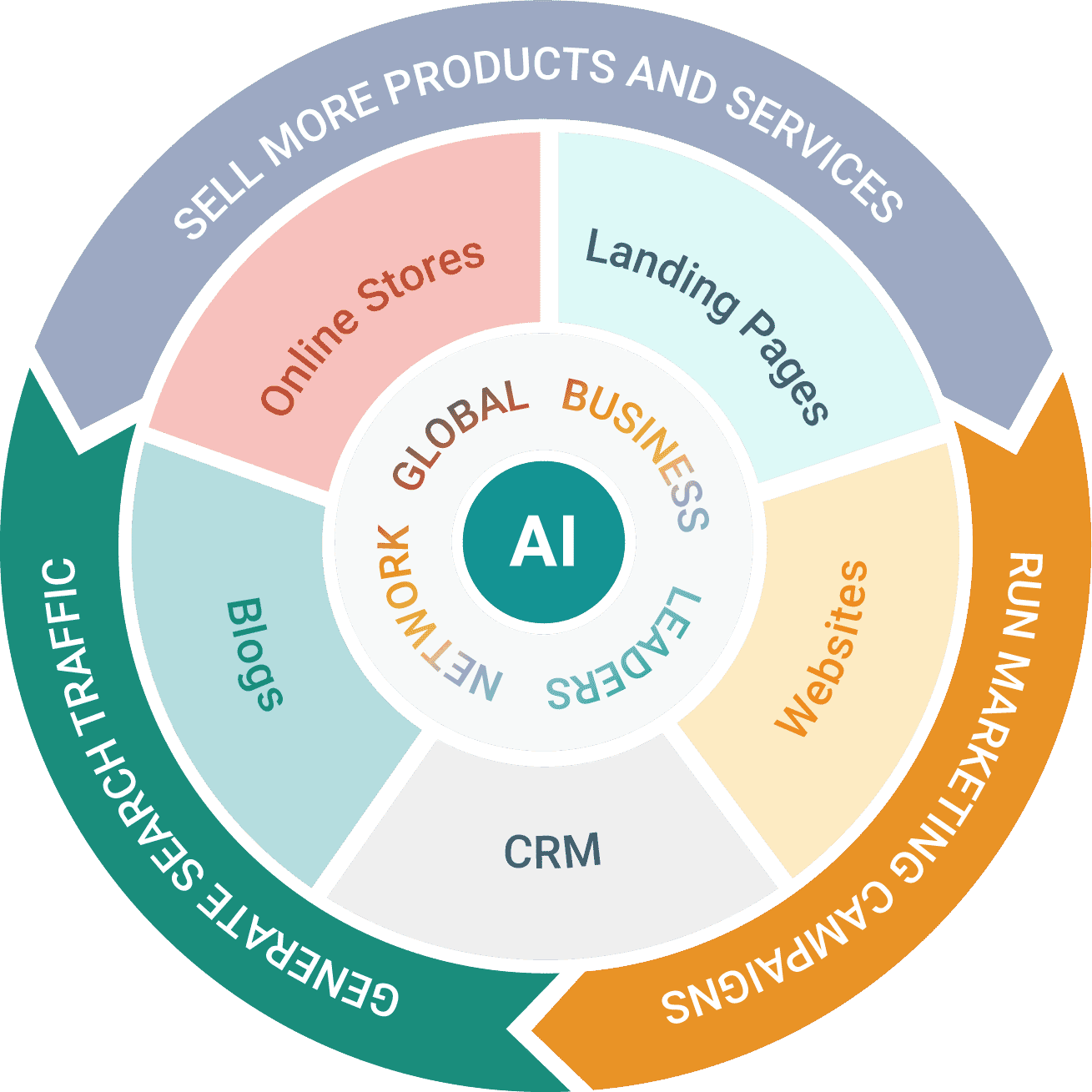

Advanced techniques have made possible enhancements in automation, precision, speed, digitization, customization and sustainability. U.S.-based technology enhancements under the term Manufacturing 4.0 are changing the ways business leaders explore procurement opportunities. The technologies include artificial intelligence, robotics and automation, the Internet of Things (IoT), big data and analytics, digital simulation and sustainable production.

Role Of Policy

Policy is an essential aspect of the macro-context within which economic, geopolitical, social and environmental trends impact tech development. As firms write their growth strategy, for both inorganic and organic growth, they evaluate financial returns (i.e., internal rate of return, net present value) for new product investment. This must reflect expectations regarding the future of policy and technology.

Opportunity spaces develop, in part, because of technology and policy shifts. Industrial policy can preference those industries deemed a national strategic interest. Areas such as regulation, subsidies, procurement, direct investments and trade policy (i.e., tariffs) affect the capacity of manufacturers to compete for raw materials, employees, customers and private investment. Recent developments (paywall) in U.S. industrial policy have included proposed investments in Greentech, semiconductors and infrastructure.

Industrial policy is written to balance social concerns, national security and economic dynamism. Priorities include job creation, wage levels and domestic resiliency. The Whitehouse has developed a comprehensive list of “Critical & Emerging Technologies.” The list includes advanced computing, advanced engineering materials, advanced gas turbines, advanced and networked sensing and signature management, advanced nuclear energy, autonomous systems, biotechnologies, communication and networking technologies, directed energy, financial technologies, human-machine interfaces, hypersonics, semiconductors and microelectronics, and space technologies and systems.

The investment and procurement programs help advance projects by mobilizing public dollars, which catalyze private investment. For example, NASA recently joined us at the University of Richmond to discuss innovation advancements in aerospace technologies, and how the NASA Technology Transform Program helps private citizens commercialize new products—from optics to propulsion, and from deep tech to applications in consumer goods.

Opportunities Through Tech Combinations

Within the policy context, numerous stakeholders engage in technology development through research. It spans the breadth of engineering (e.g., mechanical, electrical, materials, geological) and combinations of technologies have proven compelling areas of opportunity. These combinations provide new ways to solve problems and extend benefits to target customers. This is applicable for both incremental improvements for existing products, as well as the creation of disruptive new products.

For example, AI and blockchain combinations. Dr. Swati Sachan and I recently co-authored “Can the Responsible Use of Generative AI be Governed by Blockchain’s Decentralization and Immutability?” as well as No. 1 of the “20 ‘Hot’ Small Business Trends Today’s Leaders are Watching.”

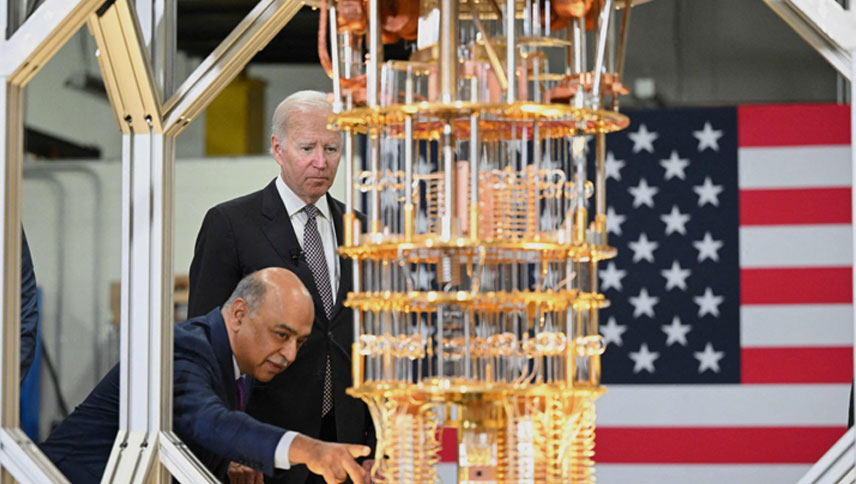

Emerging areas of “innovation through combination” include the commercialization of quantum computing applied to both manufacturing and energy. Computational power is being applied for weather modeling and trade route estimation, related risk management, optimization of blended power grids (i.e., small modular reactors, solar and conventional generation) and applications of hydrogen fuel cells.

Mixed Economic Context

Commercialization of these combinations is changing within the “higher for longer” monetary cycle, with accompanying mixed economic signals. Here is the good news:

• Forecasters are now expecting a 2.4% GDP growth rate for 2024.

• The U.S. added 353,000 new jobs in January—higher than expected—and unemployment came in at 3.7%.

• The Federal Reserve has kept its federal funds rate steady at 5.25% to 5.5%.

• Last year’s manufacturing investment reached historic highs, and we experienced a boom in construction of manufacturing facilities.

However, significant downside risks persist:

• According to CNBC, “Key Fed inflation measure rose 0.4% in January,” and, “Prices rose more than expected in January as inflation won’t go away.”

• The Financial Times claims that (paywall) “the yield curve has yet to deliver a recession because the real curve has only just inverted.” And according to Forbes, “The yield curve continues to flash a recession warning.”

• Investopedia cites that the CAPE ratio for the S&P 500 stood at 32.22 in December 2023 and that it hit a high of 28 just before the market crash of 2008.

• In our November 2023 article, “Preparing for a Potential Slowdown,” I highlighted additional effects for asset prices, including currencies and real estate.

• In 2023 we saw a spike of lost assets through bank failures, totaling $548 million.

What Business Leaders Can Do

First, find emerging revenue opportunities. This includes identifying patterns of new demand, particularly counter-cyclical demand where product development can be enhanced through tech combinations. Generative AI is showing the capacity to enhance R&D initiatives.

Second, understand the cost implications. Consider onshore manufacturing as a lower-cost, lower-risk option. The “higher for longer” economic context means related hurdle rates have increased. Advance only the most promising, synergistic product development initiatives.

Third, leverage U.S. industrial policy that strengthens innovation and supply chain resilience. Demonstrate commitments to localized manufacturing, “built to export” products, ESOP plans for employee ownership, partnerships that advance related entrepreneurship and the utilization of incentives to locate in disadvantaged communities (e.g., opportunity zones and enterprise zones).

Within this economic context, emergent combinations of technology are providing new U.S.-based manufacturing opportunities for business leaders. Innovation-led industrial policy is helping.

Source: https://www.forbes.com/councils/forbesbusinesscouncil/2024/03/15/innovation-led-industrial-policy-for-us-manufacturing/