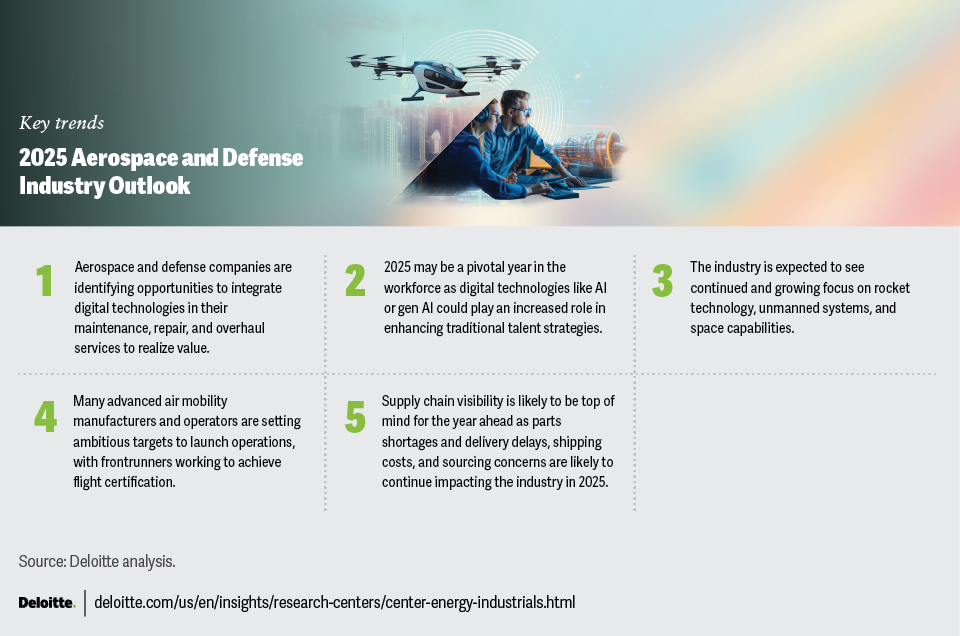

2025 Aerospace and Defense Industry Outlook

Deloitte Research Center for Energy & Industrials

By Lindsey Berckman,Ajay Chavali,Kate Hardin,Matt Sloane,Tarun Dronamraju

23 October 2024

The aerospace and defense industry is likely to see broad-based operationalization of an array of technologies

In the past year, the aerospace and defense industry has confronted various challenges ranging from supply chain issues to talent and production shortages. However, Deloitte’s analysis indicates that the industry is experiencing growth and progressing in these areas. In the commercial sector, demand for air travel was high in 2024 and recovered completely from the COVID-19 pandemic dip. According to the International Air Transport Association, demand for global air passenger traffic, measured in revenue passenger kilometers, is expected to grow by 11.6% in 2024 compared with 2023. As of August 2024, global air passenger traffic was up 11.9% year-to-date, and total capacity, measured in available seat kilometers, increased 10.2% year-to-date.

In defense, geopolitical tensions continued, pushing countries to increase defense spending. Per the Stockholm International Peace Research Institute, approximately 59 countries were at war in 2022, up by 27 countries compared to 2019. As a result, defense expenditures surpassed US$2.4 trillion in 2023 (most recent data at the time of publication).

These trends are expected to continue into 2025, with the potential for broad-based operationalization of many technologies, from artificial intelligence and advanced air mobility (AAM) to unmanned systems. Over the past year, AI has seemingly become ubiquitous, potentially indicating that companies in the sector are growing more and more comfortable with the technology. In 2025, AI is likely to help accelerate progress in various areas, including enhancing aftermarket services and optimizing supply chain.

The industry is also likely to experience continued, and possibly expedited, growth in hard technology in 2025. In the United States alone, the Biden administration has requested a budget of US$849.8 billion for the Department of Defense (DoD) for fiscal 2025. The budget priorities may act as a catalyst for further industry spending in unmanned systems and the space economy. Specifically, the commercial sector is likely to continue advancing toward AAM solutions. Finally, it is likely that, in 2025, aerospace and defense companies will prioritize resiliency and visibility in their supply chains to ensure the future of their technologies.

Deloitte’s 2025 Aerospace and Defense Industry Outlook explores all of these and more through the following trends:

- Aftermarket services: Artificial intelligence and digital technologies appear poised to lead a revolution in delivering value through maintenance, repair, and overhaul

- Workforce: The industry is leveraging digital technologies to attract talent and buttress traditional talent strategies

- Strategic spending: Defense priorities are helping shape spending in the industry

- Advanced air mobility: The industry is marching toward flight operations through scaling, certification, and acceptance

- Supply chain: Elevating visibility remains a priority for the industry

1. Aftermarket services: Artificial intelligence and digital technologies appear poised to lead a revolution in delivering value through maintenance, repair, and overhaul

The resurgence in air travel over the past year significantly boosted demand for new aircraft. As aerospace and defense companies are faced with quality challenges in the supply chain and diminished fleet availability, the call to extend the life of existing commercial aircraft is growing.

One way to lengthen the operational lifespan of aircraft is through effective maintenance, repair, and overhaul (MRO). Thus, companies are identifying value opportunities like integrating digital technologies to address the need for greater efficiency and cost-effectiveness with improved MRO services.

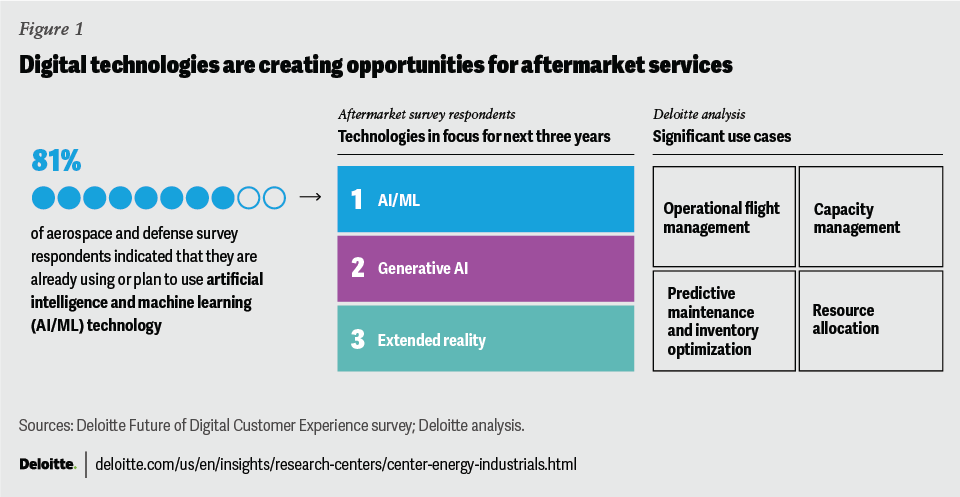

According to a recent Deloitte survey, 81% of respondents from the aerospace and defense industry reported that they are already using or plan to use artificial intelligence and machine learning (AI/ML) technology. Responses from aftermarket companies also indicated that AI/ML, generative AI, and extended reality are the major focus technologies for the next one to three years (figure 1). The AI/ML and digital revolution is helping to revamp sustainment practices, with an emphasis on enhancing both operational efficiency and customer experience.

Some MRO companies are currently implementing AI in one-off areas such as predictive maintenance. These one-off areas are likely to become part of a broader digital strategy for sustainment in 2025. The same aerospace and defense companies implementing these strategies will likely take a more global view of their operations and leverage digital technologies to plan out their work. Intelligent MRO operational planning can add predictability to sustainment practices, helping to ensure that aircraft are available when needed for the customer. Companies in the commercial sector will likely use intelligent MRO services to ensure consistent aircraft availability, while those on the defense side could do so to maintain a steady stream of mission-capable aircraft.

Regardless of sector, this availability comes down to minimizing maintenance downtime. To achieve this end state, companies will likely look to integrate solutions in several critical planning stages, optimizing for time, technicians, and parts (figure 1).

- Operational flight management: When is the best time to bring in the aircraft? Predictive capabilities can help operators understand the operational flight schedule and balance the need for aircraft availability with maintenance requirements.

- Capacity management: AI is expected to have applications in capacity. Currently, simulation technologies can help determine whether there is sufficient capacity—physical space, technician, and parts inventory—to intake an aircraft for maintenance. In the future, AI will likely play a crucial role in calculating how long any one aircraft could occupy a physical opening for MRO servicing. Ultimately, this capability could help MRO and aircraft operators simulate capacity availability more effectively.

- Predictive maintenance and inventory optimization: AI can analyze historical data to predict repairs that are likely required and forecast which parts may be needed. This, in turn, can optimize inventory and reduce downtime, allowing for better preparation and resource allocation.

- Resource allocation: AI can ensure that the right parts, resources, and technicians are available at the right time, and are allocated where they are most needed. The technology can also identify the nearest available replacement and the best-suited technician for the task and share it with the aircraft operator.

As AI applications improve in the MRO space, the industry could expect to see a simultaneous improvement in customer experience. By aggregating data from various sources, AI can provide a comprehensive view of an aircraft’s status and maintenance needs. MRO service providers can explore customer-specific AI-driven user manuals that provide real-time updates and recommendations based on the actual usage of the aircraft. Such actions can improve operational efficiency and customer satisfaction by carrying out maintenance activities seamlessly and making aircraft available when needed.

2. Workforce: The industry is leveraging digital technologies to attract talent and buttress traditional talent strategies

In 2024, the aerospace and defense industry continued to struggle with talent attraction and retention challenges, and these challenges are likely to persist into 2025. In fact, over 67% of respondents in the National Association of Manufacturers’ outlook survey for the second quarter of 2024 identified “attracting and retaining a quality workforce” as a primary business challenge. Although the industry has faced this issue before, 2025 may prove to be a pivotal year for aerospace and defense companies considering the role digital technologies like AI/genAI could play in enhancing traditional talent strategies.

Talent attraction

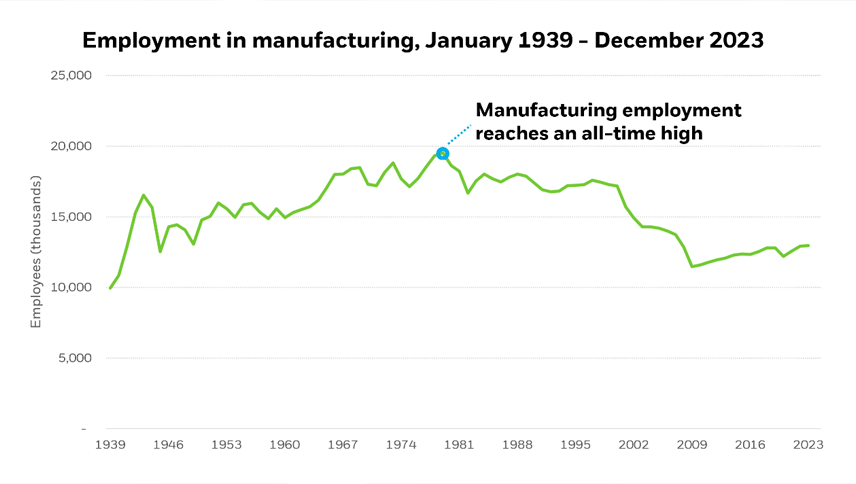

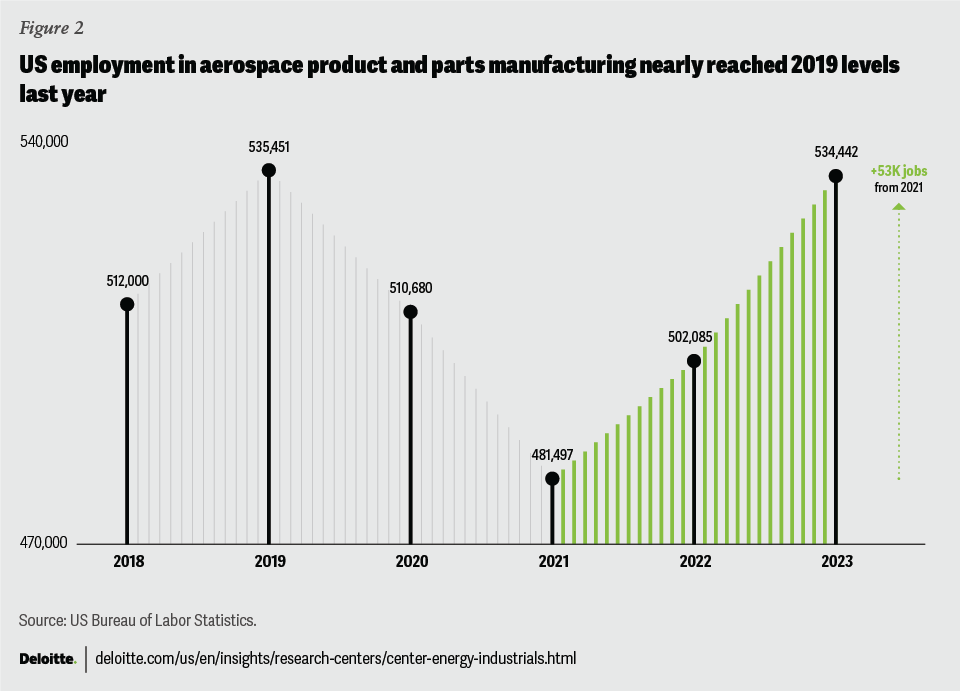

Current labor market demand in the aerospace industry has surged compared to 2019 levels. In fact, one leading global aerospace original equipment manufacturer (OEM) estimates that the commercial aerospace segment in the United States alone could require an additional 123,000 technicians in the next two decades. Employment in aerospace products and parts manufacturing in the US now sits at 534,442 (figure 2).

To build their organizations, aerospace and defense companies are likely to use a bifurcated strategy for talent acquisition that focuses on both national and local job markets. On the national level, the industry is expected to continue to offer higher-than-average wages and opportunities to use complex technologies to attract engineering talent.

Locally, aerospace and defense companies are likely to employ an ecosystem approach, defined by public-private partnerships that develop and maintain a constant flow of production operations talent. Such an approach may include capturing talent by investing in work-based learning programs for students at K-12 institutions and technical colleges. Developing an early talent pipeline will likely be key, as the opportunity cost for losing technical talent is proving to be significant.

Talent retention

Member companies of the Aerospace Industries Association experienced a personnel turnover of about 13% in 2023, excluding retirements, much higher than the average turnover rate in the United States of 3.8%. The aging workforce is a persistent problem in the industry, with 25% of the workforce having more than 20 years of experience and being at or beyond the eligible retirement age. While retirement ages across the United States are increasing, any amount of retirement in the aerospace and defense industry exacerbates existing talent gaps, as retirees take with them a wealth of institutional knowledge.

Aerospace and defense companies are continuously looking for ways to extract this wisdom, avoid single points of knowledge failure, and mitigate the material impact of retirements. As such, companies are likely to apply both traditional and high-tech knowledge transfer approaches in 2025.

On the traditional side, the industry can expect a continuation in the renewed enthusiasm for apprenticeship programs. According to a recent Deloitte analysis, the number of apprentices in advanced manufacturing occupations increased to 59,500 in fiscal 2023, nearly triple that of fiscal year 2021.

With help from emerging technologies such as extended reality, the industry will likely begin to enhance the training environment and shorten the time it takes to bring employees up to speed. As aerospace and defense companies account for the current talent challenges, they are likely to begin to plan for deploying people and fostering career development opportunities with the same rigor that they plan for parts and products. Sales and operations planning that emphasizes workforce planning can help in properly translating product demand into people demand. These and other planning imperatives, such as the basis of estimates, are expected to see greater support and optimization in the year ahead from digital technologies like AI.

3. Strategic spending: Defense priorities are helping shape spending in the industry

While the demand for aerospace and defense products and services comes from both the commercial and defense sides, much of the strategic spending is being driven by, or heavily bolstered by, defense priorities. In 2025, the industry is expected to see continued and growing focus in several key areas, including rocket technology, unmanned systems, and space capabilities.

The space economy continues to grow, fueled by the commercial sector

According to the Space Foundation, the global space economy grew to US$570 billion in 2023, a 7.4% year-over-year increase (in line with a predicted five-year compound annual growth rate of 7.3%), driven primarily by the commercial sector. In particular, the positioning, navigating, and timing (PNT) subsector accounted for about 47% (US$209 billion) of the commercial total of US$445 billion. This market is expected to grow by 155% by 2035 and may be the prime focus in the year ahead. Companies in sectors from supply chain management to transportation are likely to continue to lean on PNT technologies for location-based services.

Rising investments and focus on solid rocket motors in the defense sector

The US defense budget request for fiscal 2025 reflects the DoD’s continued focus on investing in strategic areas to strengthen the defense industrial base by leveraging the Defense Production Act Purchases and the Industrial Base Analysis and Sustainment programs. These programs have a combined total budget request of US$1.5 billion. Meanwhile, US$163.4 million of the fiscal 2025 budget request is allocated to hypersonic research and development efforts to address lead time and sub-tier 1 supplier issues for thermal protection and solid rocket motor technologies.

This priority for solid rocket motors ranges from missile technology to requirements in the space arena. In fact, a focus on solid rocket motors is not new but a continuation of a growing trend that is contributing to a flurry of commercial activity. In the past year alone, the Army, Navy, and Air Force have invested over US$100 million in new market entrants working to develop large solid rockets. In just the last two years, there have been a number of high-profile deals in the aerospace and defense industry: A US prime contractor acquired one of the two solid rocket motors providers in the United States and two primes signed a strategic agreement to produce rockets in large quantities.

Over the last decade, the DoD budget requests for procurement and R&D related to missiles and munitions have increased by 340%, reaching US$30.6 billion in fiscal 2024 from US$9 billion in fiscal 2015. These signs indicate that the industry can expect to see continued growth in the global solid rocket market through 2025.

Unmanned aerial systems at the forefront of defense and commercial expansion

Geopolitical tensions are contributing to much of the current and projected focus of defense spending. Nowhere is this impact more evident than in the unmanned systems (aka drone) market. A year ago, some estimates valued the 2023 global military drone market as high as US$20.21 billion.

The pace for unmanned systems will likely remain in focus in 2025. The fiscal 2025 DoD budget request allocates a portion of the US$61.2 billion for air power to unmanned aircraft systems like the MQ-4 Triton and the MQ-25 Stingray.

On the commercial front, operators are finding applications for unmanned aerial systems in an array of industries including construction, real estate, infrastructure, oil and gas, agriculture, and logistics. In a landmark decision for the US aviation industry, the Federal Aviation Administration will now allow simultaneous beyond visual line of sight flights for multiple commercial operators in the Dallas area. This, in addition to potential sanctions on foreign-made drones, may set the stage for further growth in unmanned aerial systems.

From military demands to commercial applications, 2025 is shaping up to be a year of continued growth for several next-generation unmanned technologies in aerospace and defense.

4. Advanced air mobility: The industry is marching toward flight operations through scaling, certification, and acceptance

The advanced air mobility (AAM) industry, focusing largely on electric vertical takeoff and landing (eVTOL) aircraft, has received attention and investment in recent years. Professional investors are showing a growing attraction to the potential of AAM, with 93% of a cohort of managers responsible for more than US$1.787 trillion of assets under management (AUM) expressing an interest in the eVTOL sector.

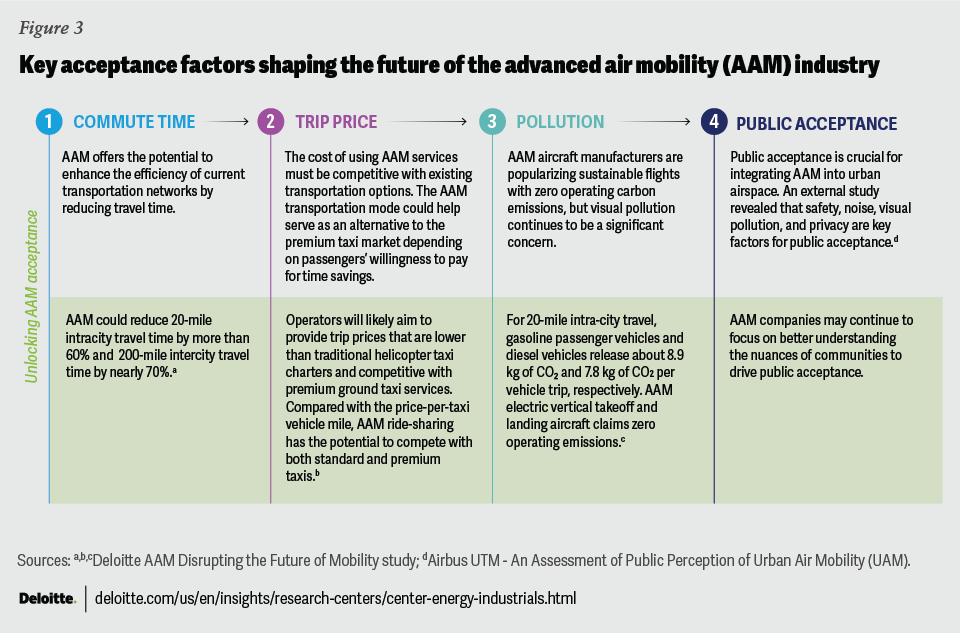

EVTOL aircraft are quieter and more environmentally friendly compared to their counterparts due to their electric propulsion systems, resulting in zero operational emissions. While these systems are being considered for cargo transportation and military applications, the greatest value proposition is likely in the urban air mobility passenger market. AAM aircraft offer a viable alternative to traditional helicopters and ground transportation modes for urban and regional travel.

However, AAM can likely only reach the masses when operators provide per-seat pricing on par with premium taxi services—a reality that a recent Deloitte study revealed could be possible. This type of competitive price structure is likely possible only by deploying a large number of aircraft and by operating at maximum utilization and load factor.

Currently, the frontrunners in the AAM industry are progressing flight tests and partnering with various stakeholders to enhance or manufacture various parts and components, including airframe structures, batteries, and avionics. These partnerships aim to advance production plans, build manufacturing plants, leverage and build infrastructure such as vertiports, and develop initial air taxi networks. In fact, several cities and regions are conducting pilot projects and flight demonstrations to validate AAM concepts and business models.

As the demand signal grows for AAM solutions, OEM success and sustainability could hinge on the ability to achieve near-automotive-scale production rates with aerospace-level quality. AAM OEMs have an opportunity to realize value by applying an array of methods to scale manufacturing, specifically centering around teams, technologies, and capital.

In 2025, AAM OEMs are likely to continue along the path to mature flight operations as outlined in the Federal Aviation Administration’s Concept of Operations v2.0. In June 2024, the FAA published a draft advisory circular that provides air-worthiness guidance for two designs produced by two of the largest OEMs, and in September 2024, the US FAA published its Draft Engineering Brief (EB) 105A, Vertiport Design to provide interim guidance for the design of vertiports.

Many of the AAM manufacturers and operators are setting ambitious targets to launch operations, with frontrunners continuing to march toward flight certification. Two of them are targeting AAM services as early as 2025. Beyond airworthiness, 2025 is expected to see many industry leaders working to achieve general acceptance from both passengers and the community at large. From a passenger perspective, this likely means prioritizing safety, price point, and commute time, while for the community, this likely means mitigating pollution (mainly visual) and leveraging current infrastructure systems (figure 3).

5. Supply chain: Elevating visibility remains a priority for the industry

The aerospace and defense industry comprises a highly complex supply chain with multiple tiers of suppliers. For instance, an average US commercial aerospace original equipment manufacturer (OEM) has more than 200 tier 1 suppliers and 12,000 tier 2 or tier 3 suppliers. These supply chains remained mostly resilient over the past few years. However, major industry players are currently confronting new supply chain challenges including everything from securing their most critical materials to ensuring part and component deliveries. While many companies have begun working to balance supply chain resilience with efficiency, parts shortages and delivery delays, shipping costs, and sourcing concerns are likely to continue impacting the industry, putting supply chain visibility at the forefront for the year ahead.

The airline industry experienced strong demand in 2024 with passenger revenues expected to reach US$744 billion for the whole year, up 15.2% from 2023. Similarly, growth in revenue passenger kilometers is expected to continue at a rate of 11.6% in 2024, potentially reaching a record high of 4.96 billion travelers. This strong demand for air travel has led aircraft manufacturers to plan for increasing monthly production, largely for narrow-body aircraft.

However, aircraft manufacturers are currently facing parts shortages in their supply chains, resulting in a shift in their scaling targets. For instance, one major aircraft manufacturer’s supply chain is made up of nine layers, that contribute nearly 80% of the final jet components. Parts shortages and delivery delays are likely driven by global labor shortages and increasing geopolitical tensions. For example, many cargo ships have decided to avoid the looming threat of attacks in the Red Sea and transit completely around Africa instead. Moreover, droughts in Central America have resulted in lower water levels in the Panama Canal, limiting the number of ships passing through the canal in early 2024. The Panama Canal Authority is gradually raising the daily vessel limit. As of June 2024, the limit was raised to 34 with plans to increase it to 36 starting in September 2024, nearing the pre-drought vessel movement level of 38.

Despite these increases, the vessel limit has still caused delivery delays of up to two weeks and significant increases in shipping costs. As of June 2024, shipping rates for popular routes from China to Europe and across the Pacific from Shanghai to Los Angeles had increased to nearly five times the average pre-pandemic price.

Finally, for both commercial and defense subsectors, ensuring quality and reliability in sourcing parts, products, and components for manufacturing and aftermarket operations is critical. Issues such as counterfeit parts, substandard manufacturing practices, and inadequate testing procedures can threaten the integrity and performance of aerospace and defense systems. This problem is by no means a new one, but it is a persistent one against which the industry is likely to deploy new methods in the year ahead.

In February 2024, prominent aerospace companies, including aircraft and engine manufacturers as well as airlines, established the Aviation Supply Chain Integrity Coalition. The coalition aims to prevent unauthorized parts from entering the aviation supply chain, thereby bolstering its overall integrity. These types of efforts by aerospace and defense companies are anticipated to both prevent the introduction of unapproved parts into the aerospace and defense supply chain and identify opportunities to enhance supply chain operations in 2025.

The supply chain problems mentioned above are likely to persist into 2025. And as global trade dynamics shift and the share of international trade with the United States shifts to countries like Mexico, aerospace and defense companies are expected to focus efforts on improving their supply chain visibility. In 2025, this may entail more companies employing digital technologies to track the flow of materials from upstream suppliers (for example, tier 2 and tier 3 suppliers) to end users and help oversee supplier compliance.

What lies ahead? 2025 will likely be a year for differentiation through operations

The year 2025 for the aerospace and defense industry may end up being defined by the word “operationalize.” The industry is experiencing continued transformation, propelled by advancements in digital technologies, strategic investments, and a renewed focus on workforce development, and supply chain visibility. From talent to supply chain opportunities, aerospace and defense companies are working to integrate digital technologies and AI to address some of the industry’s persistent problems.

In aftermarket services, applications of AI for predictive maintenance have become well known, but leading aerospace and defense companies will likely incorporate AI solutions into a more holistic approach to MRO considerations. In a similar vein, we expect to see industry leaders evolve their digital applications for supply chain visibility to resolve issues ranging from parts and labor shortages to concerns with the quality and reliability of parts. In workforce, the crunch is real and frontrunners are expected to treat talent with the same attention as they do production. In the realm of new products, the industry is likely to see several key players differentiate themselves through the operational flight of advanced air mobility and unmanned systems in commercial settings.

Growth across the industry is likely to continue with technology underlying each step. The myriad technologies applied throughout the industry offer a plethora of opportunities for companies—ones that can help drive both margins and innovations for the future and seize the opportunities that lie ahead.

Source: https://www2.deloitte.com/us/en/insights/industry/aerospace-defense/aerospace-and-defense-industry-outlook.html