2025 Engineering and Construction Industry Outlook

Deloitte Research Center for Energy & Industrials

By Michelle Meisels,Misha Nikulin,Kate Hardin,Matt Sloane,Kruttika Dwivedi

2024-11-04T00:00:00+00:00

Construction firms are likely to find reasons for optimism in 2025

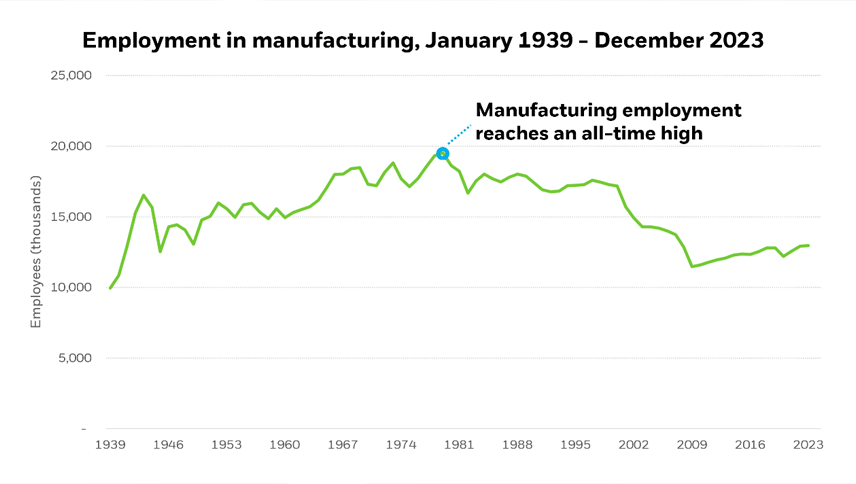

The construction industry in 2024 was defined by strong fundamentals, marked by a 10% increase in nominal value added and a 12% increase in gross output. Construction spending crossed US$2 trillion and maintained a balanced trajectory in the first half of 2024. Despite facing a pervasive talent shortage, the sector’s employment level reached 8.3 million in July 2024, surpassing its previous peak of 7.7 million from 2006. This number has been increasing steadily for more than a year now. The Dodge Momentum Index (DMI), a measure of nonresidential building spending, has been on a steady rise in the second quarter of 2024, reflecting growing confidence in market conditions among owners and developers.

Nevertheless, the industry had its fair share of challenges. High interest rates and price inflation continued to affect the residential and commercial segments. The challenging lending market and ongoing weakness in billings of architecture firms are expected to continue through the year. However, construction investment, largely driven by government investments, and an expected decrease in interest rates may provide relief to the industry over the next few quarters.

Looking ahead to 2025, there are reasons to be optimistic. According to the Deloitte analysis of the Oxford Economic Model, short-term interest rates are likely to decrease gradually over the next couple of years, following a 50 basis point interest rate cut by the Federal Reserve in September 2024. The improving economic conditions are likely to influence construction demand across various segments. Declining mortgage rates could boost demand and residential construction activity. Government investments through the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act may continue to drive growth in segments such as manufacturing and energy.

Moreover, with the increasing uptake of artificial intelligence and advanced computing across industries, data center construction is also likely to gain steam. Overall, the US construction industry is likely to record moderate growth in the medium term with slowing inflation and a supportive monetary policy.

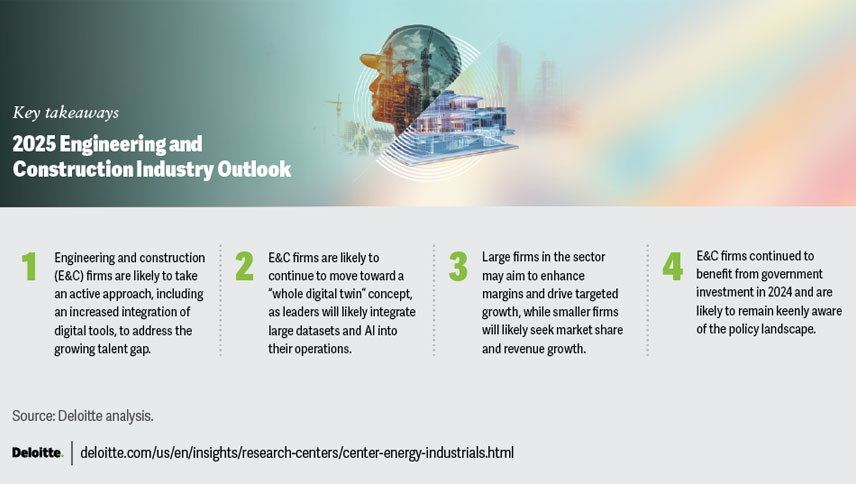

As engineering and construction (E&C) firms plan for the upcoming year, there are four key areas that may help them capitalize on the projected industry growth and tackle any unforeseen challenges:

Managing the labor mismatch: E&C firms will likely use a variety of strategies to build an agile workforce

Increasing technological integration: Evolving technologies can continue to transform E&C operations across the value chain

Financial considerations: E&C firms strive to drive growth from strategic divestitures, capital allocation strategies, and the growing role of private equity

Industrial policies: E&C firms are likely to remain agile in the face of an evolving policy landscape

1. Managing the labor mismatch: E&C firms will likely use a variety of strategies to build an agile workforce

The construction sector continues to grapple with a significant talent shortage. Between August 2023 and July 2024, the industry had an average of 382,000 job openings each month—a third consecutive year with an increased average close to 400,000. The growing average job openings may be linked to increased spending in areas like manufacturing and nonresidential construction. This challenge is expected to intensify as the industry anticipates growth in the coming years, raising concerns about how to bridge the persistent—and now growing—labor gap.

Labor attraction is a predominant issue for construction firms, affecting both skilled and unskilled positions. Securing onsite labor has been particularly challenging, and it is hard to recruit skilled workers. The current landscape is further complicated by the construction of data centers, semiconductor manufacturing facilities, and megaprojects that require specialized labor such as welders and electricians. Estimates suggest that the construction of a large data center typically creates nearly 1,700 local construction jobs over a period of 18 to 24 months.

The engineering and construction industry is also witnessing a shift in skill requirements. For instance, 44% of the current skill requirements in infrastructure are expected to evolve over the next five years. This is expected to further complicate the talent search as companies strive to fill gaps in both traditional labor skills and those required for a digital, more automated future. Demand is rising for digital skills such as data and analytics, cloud computing, and software development, alongside soft skills like people, business, and supplier management.

An aging workforce presents another issue, with projections indicating that, by 2030, the average age of craft workers will be 46 years. Firms also face a perceived lack of interest among younger generations who possess different expectations when it comes to work and the working environment. This creates a unique challenge necessitating a balance between institutional knowledge that experienced employees bring and the new skills and perspectives of younger employees.

The industry is likely to keep an eye on several important workforce issues in 2025. Talent shortages are likely to remain a key concern for the E&C industry. In particular, the increase of manufacturing construction and the continued build-out of data centers and energy-specific projects could put additional pressure on the industry. For example, skilled labor shortages and increasing construction costs could delay some natural gas projects on the US Gulf Coast. Additionally, industry players are likely to monitor the evolving blend of skills (technical, digital, and managerial) necessary to satisfactorily complete major projects.

The engineering and construction industry could consider a multitude of strategies to address these issues in 2025. Such strategies may include:

- Integrating AI-enabled automation and digital tools: These tools can augment workforce productivity by helping workers focus on high-value tasks. They could also help attract younger workers to the industry while aiding the retention of older workers by reducing physical strain and enhancing safety. Additionally, AI-powered technologies like robots or autonomous machines can be used in labor-intensive trades like drywall installation, thereby helping the workforce to perform more tactical jobs.

- Offering more opportunities for career growth and diversification: To combat high turnover rates, organizations can encourage cross-skilling and internal mobility through job rotation and cross-training. The use of experiential learning tools like augmented reality and virtual reality, for example, is one way to help workers build new skills. Training tradespeople and technicians on a variety of tasks and developing diverse skill sets is becoming more common, driven by a desire for a more consistent work environment, higher wages, and more challenging work.

- Recruiting from outside of the sector: Companies may also tap into alternative sources of talent, such as employees transitioning from tech and other sectors.

- Creating partnerships: Companies can focus on or scale up ecosystem partnerships with academia and government to help create a steady talent pool by offering apprenticeships and work-study programs.

2. Increasing technological integration: Evolving technologies can continue to transform E&C operations across the value chain

Digital tools and technologies are being explored across the value chain to enhance productivity, streamline operations, bolster safety, and improve the customer experience. Some industry firms are already using technologies such as cloud computing, IoT devices, 5G and private cellular networks, and AI in their operations. Now, they’re placing a new emphasis on scaling technology opportunities that range from the back office to project delivery and connected construction, digital twin, and elevating building information modeling systems.

Companies are leveraging digital tools and AI to increase their capacity and capabilities, aiming to offset labor shortages by using these technologies to help optimize a portion of work hours.

- Building information modeling (BIM) has been around for decades but is growing in sophistication with more efficient common data environments and the adoption of standards like ISO 19650. BIM is being used to generate digital representations of buildings and projects, which can inform material choices and schedules, help coordinate clashes in models, resolve conflicts, reduce safety and sustainability risks, and keep projects on budget. These tools also are helping companies gain capacity, giving them the ability to execute more complex projects efficiently and increase productivity from the deployment of BIM and prefabrication at scale. One mechanical and electrical construction company, for example, has improved its margins by more than doubling its BIM designers and by investing in prefabrications.

- Digital twin technologies have allowed companies to focus on adding value through exploring their digital replicas, simulating and optimizing the construction process to make workflows smoother and differentiate themselves. One US-based multinational infrastructure consulting firm is automating using digital twins and augmented reality to streamline processes and alleviate labor constraints. Companies are likely to continue building to a “whole digital twin” concept comprising the physical twin, the operational twin, and the intelligent twin (a predictive twin). The operational twin can provide an opportunity to help create data feedback loops between operations and engineering to improve the design for efficiency and safety, reduce downtime, and increase utilization. While many already incorporate the first two pieces, it is likely industry leaders will compete on the intelligent twin. The intelligent twin can help explore and identify complex patterns as it can interpret large data sets and is well-suited for AI and machine learning integration.

- Robotics and automation are increasingly gaining traction in E&C firms. Some firms are incorporating robots to transport materials autonomously, perform precise welding, plan layouts, and operate remotely in hazardous environments. With the integration of AI, these robots can be adapted to new tasks, creating smarter construction sites and paving the way for a future where automated systems, humanoids, and collaborate robots (cobots) are commonplace, working to ensure cost-effective and sustainable construction practices.

- Beyond these, companies will likely invest in the next wave of transformative technologies such as augmented and virtual reality, generative AI (gen AI) (over the next one to three years), and even more autonomous gen AI applications like agentic AI. Construction firms could continue to reinvent operations as these high-performance and cutting-edge technologies become more of a reality.

As companies continue to grow their spending and investments, technology can be explored in almost every aspect of operations. The wide adoption of drones, for instance, is facilitating precise surveying even when surveyors are not physically present. Companies have also experimented using drones for efficient inspection, inventory management, monitoring progress, and collating real-time information. A home remodeling company, for example, performs drone inspections for better efficiency and real-time monitoring while keeping workers safe. Emerging technologies are gaining traction within the sector and job sites are becoming increasingly interconnected and data-heavy, making digitalization crucial in the industry. Moving into 2025, companies should consider techniques to harness and analyze data to help make better decisions for future designs and project delivery.

3. Financial considerations: E&C firms strive to drive growth from strategic divestitures, capital allocation strategies, and the growing role of private equity

Against the backdrop of cost overruns due to elevated inflation and interest rates, E&C companies are expected to focus on creating value and sustaining growth through strategic divestitures, refined capital allocation, cash flow optimization, and increased private equity (PE) investments in 2025.

Large construction firms may optimize their portfolios by divesting noncore assets, cleaning up balance sheets, and reinvesting in core business areas to enhance overall performance. Companies may limit financing for or completely exit noncore business units or product lines. They may also look to optimize their geographic expansion. These strategies aim to enhance margins and drive targeted growth.

Many large firms may consider shifting from lump-sum contracts to reimbursable projects to improve earnings predictability and cash flow. Companies may also implement strategic cost reduction programs from shared service delivery to strategic sourcing and category management for materials and services to optimize cash flow. Owners are increasingly prioritizing projects in industries that promise higher returns on investment while minimizing short-term risks.

Somewhat conversely, smaller firms will likely seek market share and revenue growth, attracting interest from large firms as well as PE investors, presenting new opportunities for expansion.

Mergers and acquisitions activity will likely be an important growth strategy for both large and small firms. Between August 2023 and July 2024, there were 528 completed M&A deals in the construction industry, totaling more than US$38 billion, which is more than three times the deal value from the previous year.

Deloitte’s analysis of major deals revealed that construction firms are integrating vertically as well as horizontally. Vertical integration deals include acquiring companies within the supply chain (such as building products manufacturers and their suppliers) to enhance control over production and distribution. Horizontal integration deals include acquiring competitors or companies at the same stage of the value chain. These deals may also help companies consolidate market presence or diversify offerings by target product lines such as building products, cement and aggregates, steel, solutions for heating, ventilation and air conditioning, clean room solutions, and homebuilding services.

With increased governmental spending in sectors such as transportation, broadband, and clean energy, PE firms may pursue more buying opportunities in the construction sector. Between August 2023 and July 2024, there were 112 completed M&A deals in the construction industry from PE investors, totaling more than US$14 billion, almost double the deal value in the previous year. Deloitte’s analysis of major deals by PE firms in the construction industry indicates that they are primarily focused on strategic expansion and operational and technological enhancements. In the coming year, PE firms may seek to expand their portfolios and industry footprint by investing in construction technologies and automation. Solar technology, renewable energy, and clean energy construction projects also are expected to be prime prospects for PE investors.

As prices of construction materials have moderated in the last few months, E&C firms may find it easier to manage costs if this trend continues through 2025. Effective resource allocation will be important as firms emphasize strategic investments to achieve sustainable results.

4. Industrial policies: E&C firms are likely to remain agile in the face of the evolving policy landscape

The engineering and construction sector continues to benefit from government investment. For example, since the IIJA was signed into law in 2021, total manufacturing construction spending has more than doubled.

Industry players are likely to continue to closely follow the macroeconomic situation and any policy shifts that could have an impact on the E&C sector, including federal investments. In 2023, there were 1,326 new unique recipients with US$2.15 billion of IIJA obligations, compared with only 542 new unique recipients with US$325 million of IIJA obligations from January 2024 to August 2024. Actual spending has been increasing at a more moderate rate than the subsidies offered under these pieces of legislation.

Finally, E&C firms will continue to follow trade policy developments, such as the recent increase in tariff rates on various strategic materials like steel and aluminum, which can have significant impacts on cost and delivery times.

E&C firms will likely continue to align their operations to capitalize on any government incentives and policies in the coming years.

Embracing changes to capitalize on growth opportunities in 2025

The E&C sector is not new to disruption and volatility, and evolving economic and regulatory factors are expected to play a pivotal role in shaping the upcoming year. Nonetheless, 2025 could present opportunities for continued growth. To capitalize on these opportunities, E&C leaders should keep a close eye on the following factors in their considerations for key decision-making:

- Changing talent requirements: The labor mismatch and evolving skill requirements need innovative workforce strategies, including automation, enhanced worker experiences, and diversity initiatives. The sector’s ability to adapt to an aging workforce, integrate new technologies, and attract new employees will be important in working to meet the demands of a rapidly evolving market and ensuring a robust and skilled workforce for the future.

- Technological advancements: Advancements in technology will continue to modernize the construction industry in 2025. The sector is more readily implementing technologies like BIM, digital twins, robotics, and automation. These technologies may help streamline project management, collaboration, and decision-making while reducing delays and costs. With wide-scale adoption, companies could experience improved productivity, safety, and resource allocation.

- Market dynamics: Changing economic conditions will likely be critical in shaping the construction industry in 2025. Lower interest rates and falling inflation may reduce project financing costs. This ease in financing will likely encourage both public- and private-sector investments in construction.

- Evolving policy landscape: Federal infrastructure investments like the IIJA will likely continue to benefit nonresidential infrastructure projects, including transportation, manufacturing, and utility facilities. The recent increase in tariff rates on strategic materials like steel and aluminum aims to boost domestic production capacity but also could potentially raise the risk of reciprocal tariffs.

Source: https://www2.deloitte.com/us/en/insights/industry/engineering-and-construction/engineering-and-construction-industry-outlook.html