How to Build a Moat Strategy That Wins

Stevie Case CRO, Vanta

Nov 20, 2023

Mark Roberge: Hey folks, welcome to the Science to Scaling podcast. I’m your host, Mark Roberge. Today we talk with Stevie Case, the CRO of Vanta. Stevie had a great career running mid market sales at Twilio. And about a year ago, came out of this great company called Vanta. To help them drive in the next phase of growth.

The thing we’re going to dive in today is something called ankle biters. If you are an entrepreneur that experiences ankle biters, congratulations, you have graduated into the next phase of compliments. You have created a company. And a category that is successful. So successful that the competition comes in, that they get funding, that they copy your product, that they sell it for half the price.

Some of you might be shaking your head. Yes. And it’s a pain, but it’s a compliment. That’s definitely happened for Vanta and for Stevie. And she’s got one of the best stories I’ve heard on how to offset and mitigate against those ankle biters.

We got some great stuff to talk about with Vanta and like. Before you go there, though, like, did it take you 23 years to graduate college?

Stevie Case: Yes,

Mark Roberge: it did. Did I read your LinkedIn ride? Is that a typo? It

Stevie Case: may be more like 25, but yes, that is a true story. I finished my degree that started in 1994 during the pandemic.

Mark Roberge: So what were you doing? Like, why’d you, why’d you stop college and then? 25 years later, I go back.

Stevie Case: I did a couple of things in there. And, uh, the very short version of the story is that back in the late 90s, I went off to the University of Kansas with grand dreams of becoming a lawyer and going into politics and constitutional law.

And a couple of years into that, I was hanging out in the honors dorm at the University of Kansas, and I started playing video games with some friends. And my life took this very unexpected detour that led me to drop out of college and become the world’s first professional female gamer playing Quake back in the day.

Mark Roberge: That is sick. That is sick. Like I, What was Quake?

Stevie Case: It was a first person shooter and it was a PC game. So I was very much a PC gamer, not console. And you know, this is classic, like mouse and keyboard, WASD, like navigating through a 3d space. It was one of the very first games that you could play multiplayer.

So these are early days of the internet. Imagine going into the console of a game. Uh, sort of looked like a terminal and typing the IP address of servers to connect and play with other people. That’s how long ago we’re talking.

Mark Roberge: That is crazy. Did the experience of being a professional gamer, do you draw on anything you learned there as a CRO?

Stevie Case: Absolutely. Yes.

Mark Roberge: Really? Yeah.

Stevie Case: I mean, being a CRO is, is a version of the same game. It’s resource allocation. It’s strategy. It’s people, technology, and art all wrapped up into one. You’ve got to have strong intuition. Yeah. I, I pull those same skills all the time in my current role. And I think it’s part of what makes me.

good at the job, but also unique in my role because it is, uh, I’m drawing on a lot of the same math and art that I did from my gaming days.

Mark Roberge: Well, that is so cool. And congratulations on Twilio and your role there and congratulations on kicking butt at Vanta now. And like, We pretty much want to unpack that a little bit.

So can you take us back to when you joined Vanta? Why did they bring you in?

Stevie Case: Yeah. So I came in early last year. So March ish of 2022. And As I was leaving Twilio, I was really looking for three things in the company I was going to join. One was really clear, strong product market fit. And Vanta had delivered on that in spades.

It was a company that was a rocket ship that had just tremendous inbound demand and interest. And so that one was a clear checked box. The second was I wanted to join a company that was ready to scale. So not just something that was like good in a single product thing, but truly a company that was ready to become more of a platform and grow to that next level of scale.

Vanta had raised a Series A, was on the precipice of raising the B, you know, was north of 30 million in ARR, but like had that vision to get to a hundred million in ARR. It was that run I wanted to go on and help take company on. And the third was an incredible. partner in the CEO. I wanted to feel great, both just from a personality standpoint and intellectually and from a value standpoint that we were aligned, that I had a great partner and somebody I wanted to work with for years to come.

And I found that in Christina Casioppo, CEO. She’s the founder of Vanta. She created the product from scratch. She created the market. So when I entered, Vanta was coming off this incredible run through the Series A, huge growth, 100 percent inbound, a sales team and a CS team that really had no segmentation, it was just the sales team, and they took anything inbound, there was very little outbound, and a couple of things had changed over the, the, Six months that led into my joining and the biggest of those is we had a ton of copycat competitors come on the scene and those copycat competitors were extremely aggressive.

They came to market because they saw how strong the product market fit was, how big the opportunity was, and they essentially came to market specifically to take us on. So team’s confidence was a bit shaken. We had folks on the scene with really strong marketing, trying to make a lot of noise and really trying to come and undercut us on price and just win logos at any cost.

And it was a, it was a real moment for the team to figure things out.

Mark Roberge: It’s a compliment to what you all did. You know, it’s like you created this category and. It’s attractive. And you said there were a lot of, how many came in, how many

Stevie Case: copycats? As of today, we count 43 distinct copycat competitors in the space.

And it’s a huge range. We see all different types, but really they have all come to market. with a copy of Vanta’s original product, which is such a testament to what Christina built and the opportunity she identified here. There are a couple, there’s like a cohort of three or four that have managed to get a certain amount of traction.

And at the time I joined, there was one in particular that was extremely aggressive, had clearly used and had access to our product and copied it screen for screen.

Mark Roberge: Uh, yeah, like this is going to happen if you’re successful. There are going to be people who copy your product, reverse engineer it and charge half the price.

So you better have the strategy, the playbook, the competencies to continue to win. I remember at HubSpot, like one, I don’t know, year four, maybe, you know, we, one of our, the main incumbents out there bought one of our competitors and started selling it for a dollar a year subscription. I think our average price was maybe like, I don’t know, 8, 000, 10, 000 a year.

That was tough, but if you’ve done your job, you will work your way through that and continue to capture market share. So let’s continue on and hear how Stevie’s done that.

Stevie Case: Basically copied the website, just came straight at us. And the proposition was, we’re just as good, but we’re a lot cheaper. And that’s what I was facing coming in.

In fact, that competition was so intense that when I received an offer to join Vanta, One of those competitors, uh, investors got wind of it and actually directly tried to attack me with FUD and get me not to join the company. That’s how aggressive they were and directly trying to take us on.

Mark Roberge: Wow.

Stevie Case: It has been a journey.

And you know, the truth is, every, but every great investor will ask you, what’s your moat? Like, what do you have that? Protects your business. And, you know, I’m a big believer that strong execution is the only real moat that you can build in many cases.

Mark Roberge: Yeah. I mean, if I can humbly maybe disagree a little bit with Stevie on the importance of moat, I agree in the sense that like, you don’t always need it.

And you could outpace it, but if you have it, it’s a huge advantage. And if you want to read like the work that I always rely on with Mo is an old school work by Michael Porter and Porter’s five forces and his work on barriers to entry, but essentially though, like she kind of is saying they had a Mo and we’re going to unpack that in a second.

Like they had multiple years of experience ahead of the customer. They had a better product. And so the Mo test that I encourage entrepreneurs to think about is. This is a great idea and you’ve had good traction. What if five amazing engineers from Google quit, got a 10 million term sheet from Sequoia and copied your product and sold it for half the price.

Why do you still win? That’s the moat test. It’s not like, Oh, we have this particular feature. Then it’s like, well, how long would it take them to build that feature? I don’t know, three months. Okay. Well, that’s not a sustainable moat. So just think about that a little. And we hear specifically with Stevie and Vanta on how they leaned into that.

Let’s get back to her.

Stevie Case: And so this has been a journey that we are still on. And the first move really was starting to rebuild. Confidence. And so there are a lot of tactical things you can do to rebuild confidence on the team. But the truth is, when you have a sales team, confidence matters. They have to truly believe that they’re bringing to market the best product.

And that’s one of the first things we did was, okay, let’s do some education. We had to overcome this idea that the right thing to do with ankle biters is to ignore them. We had ignored them for several months. And it’s good in theory, because you don’t want to become distracted, you don’t want to be pulled off the path by these ankle biters, but in ignoring them, we allowed them to get a foothold they never should have had, because the truth was, we did have the best product, we did have a multi year lead, we were the most innovative.

And when we ignored them, we allowed them to redefine our story for us in a way that wasn’t true and to out market us at that point. And that was a huge mistake. So rebuild confidence was number one.

Mark Roberge: Does a customer care about a multi year leader? Was that more just. You’re all confident.

Stevie Case: There’s a story in there that your team has to tell to customers.

And the answer is customers should care. They won’t unless you explain to them why it matters. And in our case, it mattered because many of our customers use our platform at Vanta to become compliant. Often that’s to become compliant with standards like SOC 2 or ISO 27001. That’s not a one time event. It is a multi year journey that evolves.

It’s this security maturity journey that we help our customers go on. And at Vanta, we had been at that for several years, so we knew what year two looked like for our customers. We knew what year Three looked like and that helped define what we built so we could help our customers avoid those pitfalls at the beginning of that journey of becoming secure and compliant.

Our competitors didn’t even know what year two and year three looked like. So they couldn’t build for it. So while they had at the time, what looked like a flashier UI and, you know, a nice, splashy marketing website, the truth was. Deep down in the weeds of the product, we knew we had built to help our customers be more successful.

It is shockingly hard to convince buyers, even when you have the better product. And we, we faced that problem because a lot of these competitors came on the scene. They had great marketing to your point. They had a flashy demo. They, uh, really cherry picked proof points that made it look like they were growing much faster than they really were.

The thing we finally landed on that worked. Was a handheld trial guided by our S. E. S. where we allowed prospects to do a seven day. Try it before you buy it with three S. E. driven check ins. So 1 of the things we knew is that a lot of these competitors did not have the ability to do a trial at all. So they had technical blockers and we use that to so far to say if they won’t let you try their product, what are they actually hiding?

It’s all sizzle, but there’s no, there’s no meat. And then two, if they did in the rare case, let them do a trial, they would see because they spent more time, the depth of product, they would see the quality was better with Vanta. So that move doubled our win rate. So when we run a trial, we went from about a 35 to 40 percent win rate, depending on the month to more like a 70 to 80 percent win rate.

And that was a game changer for us. It also started to address that issue on our team of confidence, because then they saw when prospects actually try the product, they also tell us ours is better. And so it was this like, Oh, I guess it really is better. Like we believe now because the prospects are telling us that was a key inflection point.

Mark Roberge: This is a key point to highlight for a variety of reasons. First. Yeah, you might have the easiest to use product. You might have the best product, but it’s really hard for the customer or buyer to understand that if you’re only relying on a demo. Even though you out engineered them, they can out demo you.

And relying on a trial really helps to mitigate that risk and align your sales process with your strength. Whether that’s ease of use. Best product, best design, whatever. Stevie does a great job here. The other thing that I want to highlight is how well she and her team are executing the trial. All too often, salespeople think, I put the buyer in the trial, the product’s going to sell itself.

It doesn’t work that way. Before you put them in the trial, you needed to find success. Yeah, we can do a seven day trial, but what is it that you will see after the seven days trial? that will make you buy this product? And do I have your commitment? That’s a key scaffolding around the trial experience.

The other aspect here, the other technique here is what we call a give get, where we are happy to give things to the buyer, but we need to get things In exchange of equal value, a seven day trial with all these sales engineers is a big give the get I could ask back is, do I have access to your CFO to go through an ROI presentation after, do I have your verbal commitment that you will sign this contract and Stevie and her sales team.

Are executing these trials exceptionally. Well, let’s get back to her.

Stevie Case: Step two was the move to a value based sale. So coming in, uh, to Vanta, the sale itself, there wasn’t really a methodology in place, the conversation, because there had been so much demand in such product market fit, generally when prospects were coming inbound, it was sort of like.

Vanta, do you do what I think you do? Yes. Great. Let’s go. And it was a quick lots of one call close. Very short sales cycle. We really didn’t have to do a lot of objection handling until all these other players came on the market and we grew in size. When that dynamic changed, we had to up our game. So, I took the team through what is an ongoing journey from no methodology in a very feature function based conversation towards med pick for deeper discovery.

We were moving off of very basic band and we found that like the ability to have that value conversation with our customers and prospects is now another differentiator and a thing that sets us apart from the competition who are lots of sizzle. But very basic discovery, not a value based sale today before that exercise.

It was incredibly simplistic. And I think if you would have asked many folks on the team, it would be. Why do companies come to Vanta? And the answer would be. Well, it’s to get, it’s to complete the SOC 2 process and get that SOC 2 report at the end, but that’s not really the why. And what we had to challenge ourselves to do in that room, and it was shockingly hard, was to get to the root of, Why do they care about SOC 2?

What are they really trying to achieve? And at the heart of that, there are really only a few things that businesses care about. Grow revenue, reduce costs, and reduce risk. And so as a team, we spent three days locked in a room talking about connecting those dots of if a founder comes to us and they are pursuing SOC 2, are they doing it Mainly because they want to grow revenue.

Yes. What does that look like? And who’s asking them to prove their sock to compliant? Why does that person care if our customers talk to compliant? So we had to get to the heart of that. And then it’s how do they measure it? What does that mean? So if they get. If they complete that process and they pass the SOC 2 audit, uh, what is it going to do for their business?

Well, it means they can probably sign enterprise customers now. And if they complete ISO 27001, it probably means they can expand internationally and do business outside of the U. S. So it was about then quantifying that. What did it mean in terms of ROI? And then what customer case stories, case studies and stories do we have?

To explain how we’ve done that for other businesses. So we had to get out of that very tactical, like, Oh, well, they’re coming to us for SOC two into the world of what does that really do for them? Why do they care?

Mark Roberge: That’s fantastic. And I’m trying to like, um, as we translate that into actually the frontline conversations, can you try to like summarize and like what the first like 90 seconds to two minutes of.

The first sales meeting sounded like before this, before you came in and then what did the first like 90 seconds or two minutes sound like after you got the team kind of along the lines of where you wanted them to be?

Stevie Case: Yeah. The conversation before was much more facts and figures, you know, forecast was purely numbers.

It was this week. We’re going to close. 200, 000. And, uh, my level of confidence is 60%. And it was very, very, um, focused on what we thought we were going to bring in. And then what, what you see from that, and this is very typical is it becomes completely unpredictable. So, you know, you’re calling numbers, but like your confidence is all over the place.

You see numbers slip, you see deals push, nobody can really nail down why. So. Moving that into this value based framework with deeper inspection, it becomes much more deal specific with a focus on compelling events. So the conversation is now. Yes, here’s the number I’m calling for the week. We’ve got more nuance in that.

Here’s what I can commit to. Here’s my outside best case. And here’s my most likely forecast.

Mark Roberge: This happens a lot for ultra successful companies. She’s talking about, they had all these inbound leads. They did a pretty surface level demo that probably wouldn’t score high in the generic efficiency scoring of a sales team.

And yet they were crushing it. Many people would frame that as like, And that’s great. If you can get yourself order taking, you’ve done a great job with your product, with your strategy, but almost always it runs out at some point. And whether it’s the competitions coming in, something changes in the product, something changes in the macro conditions, whatever it is, and it’s certainly changed for Vanta and that forces us to become a better sales team.

She’s also talking about MedPick and Bant. And just so you have a definition there, you can look these things up, but MedPick is. They’re both sales qualifying matrices. They are a cheat sheet for a seller to make sure they’re gathering all the information and to score how likely this person is to buy based on this criteria.

So BANT stands for Budget Authority Need Timing. To Stevie’s point, simple. I think it’s fine for like transactional MQL driven mid market inside sales. But if you’re going to want to make the leap to more complex sales, a higher level sales motion, often used for bigger deals. Something like a med pick is better and that stands for metrics, economic buyer, decision criteria, decision process, paper process, implicate the pain, champion, and the competitor’s champion.

Let’s get back to Stevie.

Stevie Case: I like to focus on that most likely forecast, start with the top deals, and then the conversation is What gives you confidence that they’re going to sign this week? Why is there urgency? Does this, does this unlock something for them that’s meaningful in the broader business? Who are the other stakeholders that have to sign off before that gets done?

And do you understand the conversation that’s going to lead them to sign? And why might they not? So it’s a lot more deal centric, and it’s around those compelling events and the reasons why.

Advertise: Talking Too Loud, hosted by Chris Savage, is brought to you by the HubSpot Podcast Network, the audio destination for business professionals. On this podcast, Chris Savage, Wistia CEO and Loudest Talker, takes you inside the minds of entrepreneurs as they share the hilarious, informative, and most challenging aspects of building more human brands.

You can hear episodes like building a reusable notebook empire with entrepreneur Joe LeMay or the AI video revolution with Wistia’s own head of production, Chris Levine. Listen to talking too loud, wherever you get your podcasts.

Mark Roberge: Let me try to play like a very service level salesperson as I’ve been in that situation, Stevie, as many of us have. So they’re like, Oh yeah, those are good questions, Stevie. So they need to become SOC compliant. The person I’m talking to said it’s urgent. They need to have it done next week. And they told me that they’re the decision maker and they just need to give this to legal and then they’ll sign it.

So I think we’re good.

Stevie Case: Yeah. So the next question is why is it urgent?

Mark Roberge: Well, they told me they have to have it next week.

Stevie Case: Do you know why?

Mark Roberge: Beautiful. I love that. You just keep going,

Stevie Case: you keep going, you know, and like the why often won’t be there. And that’s where you got to go deeper.

Mark Roberge: Yeah. And you, I know you mentioned that when we were talking about this ankle biter strategy, not only was it the transition to the value based messaging.

But embedded in there was the mobilization of the frontline sales manager to make that happen. Force management’s great. Their co founders are part of my fund that consider them friends. They’re awesome. I love their methodology. At the same time, like just sales training in general is known for like a 10 percent retention rate in terms of knowledge capture.

And it’s that frontline manager that. You need to, to mobilize. How’d you do that?

Stevie Case: Yeah. So this really, we had some lessons learned out of this. When we got right out of the gate, we had, you know, the fast start program off the back of the training and folks were rolling through it and we found exactly what you’re describing.

This, there was this sort of like, Oh yeah, great training. And then move on. It wasn’t until we got the frontline managers fully bought in on why this matters and we had to come back to our success criteria. So for us, mission one was to increase our win rate. There was a point in time where confidence was at a low and these competitors that all showed up, we were only winning at 24%, right?

And it was way too low. And it put us in a position where we weren’t going to have sufficient pipeline to hit targets. So bringing the managers back to This matters because it is going to increase your win rate and it’s going to put your team in a position to actually hit target was one. So they have to understand it’s not just another, another training checkbox.

Like this is going to move your numbers.

Mark Roberge: That frontline sales manager is key. It’s not just about training the sales person. You’re going to go a lot more horsepower on training that frontline sales manager on coaching and reinforcing what you want that frontline sales person to do. I’ve heard the three wise, I’ve heard the five wise, but it’s like, you’re almost a two year old.

They’re like, okay, why do they want to buy? Well, they’re trying to get sock compliance. Okay. Why do they want sock compliance while they’re trying to get into a new part of the market? Okay. Why are they trying to get into the new part of the market? Well, they’ve got to put up bigger growth numbers. Okay.

Why do they have to put up bigger growth numbers while their stock is falling into a value stock and they want it to be a growth stock. Okay. Why do they want, well, their value, their, their valuation multiple is going to go from three X to seven X. Okay. Now we’re getting somewhere. And of course, as a seller, you can’t just be like, why, why?

Why? In a way you’re doing that, but you’re just sounding like a human. And as a sales manager, I’m asking the same things. I’m sort of like role modeling what I want the salesperson to say to the buyer. And as a sales director, I’m doing the same thing. The sales manager was like, Hey, why did you forecast that thing at, at stage two?

Well, because they wanted their pioneers, the SOC compliance. Okay. Why is that? And as the CRO, I’m asking the same question to see, to the sales directors. So you see how this is happening. There’s this like hierarchy pyramid effect that all the way at the top, you are reinforcing what you want that frontline behavior to look like.

All right, let’s get back to Stevie.

Stevie Case: And then two was arming them with a framework and holding them accountable for the same information. And part of that is through reinforcement in that weekly forecast. We’re asking, as leadership, the same questions of the frontline managers that we’re expecting them to ask of the team.

They’re expected to know that urgency in their book of business and the why and understand, like, they need to be able to prove they have run MedPIC on these deals and that they’re deep in their deals. And you’ve got to reinforce that in a repeatable process. So they know And expect to be on the hook for it.

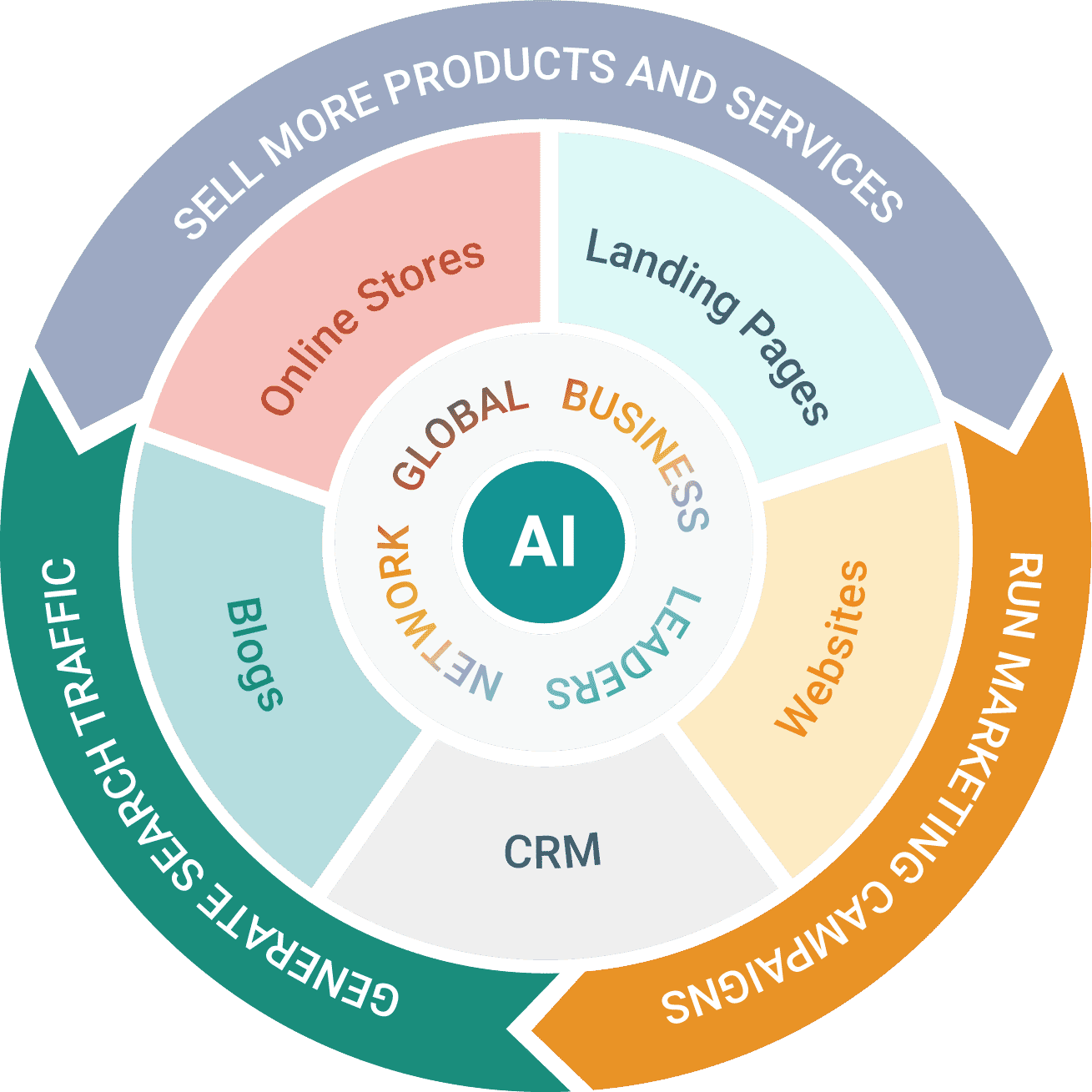

And then you’ve got to build it deep into your systems as well. So you’ve got to have a framework that reinforces these concepts. We, in fact, we’re, you know, almost a year out now from the initial training, we just launched the next phase of this, where we’re building much deeper reinforcement into Salesforce, into our CRM and into the way we collect data about opportunities.

So it’s always in the water, but those frontline managers. If they’re not bought in, it will fail and it will just become another training that people forgot about.

Mark Roberge: Now, I know a lot of folks when they move into this ankle biter competitive selling, they rely on discounts to close deals. Did you all lean in there or what, what did you, how was your feelings about that?

Stevie Case: Yeah, this has been a battle because the ankle biters Have gone so cheap and they still do. They’re still going to this low cost motion because the play particularly around the ankle biter that has gotten the most traction has been rather than focusing on revenue. They’ve just focused on logo wins, and so they’re willing to win logos at any cost when, when we’re actually not, because we’re trying to build a sustainable business.

So, you know, we did go through a long phase of just say, okay, we’re just going to match the pricing. Whatever the competition offers, we’ll match it. We’ve got the better product. We had, you know, some of our stronger salespeople, maybe they wouldn’t quite match it. They go a little bit above, but they get close and, you know, we released.

We, we implemented deal desk. We got rid of deal desk. We said, all bets are off. Just go in, just go in. And we’ve really now come around. Now that we’ve got the strong value based sale, we’ve rebuilt confidence. We are able to command a premium and we have re implemented tighter controls here.

Mark Roberge: Yeah. 99. 9 percent of the time, a reliance on discounts.

Not good. It’s a band aid for lack of sales excellence. The only exception is if you truly strategically are the low price player in the market. But that rarely happens in software. I know the classic business school cases are things like Walmart or Amazon, where they literally can afford to sell products at a lower price than the competition.

In those cases, because of their economies of scale and their economies of scope. We rarely have. Those situations in software, we have to sell value and reliance on discounting is a symbol of weakness. Good for Stevie for moving them away from that. Let’s get back to her,

Stevie Case: but it’s always a dynamic discussion because We still want to win.

We don’t want to allow them to, you know, take this cohort of folks who just want the cheapest thing out of the gate because there’s tremendous opportunity and a multi year journey that we want to build on with those prospects. So we believe there’s a huge amount of value in a strong ROI here. So it’s that delicate dance and we’re really just reassessing on a monthly and quarterly basis.

Are we going too far with discounts? Should we go a little bit farther than we have? And, you know, you’ve got to be agile to respond to the market there.

Mark Roberge: Well, I’ve learned a lot here, and I’ll tell you that it is a compliment if ankle biters arrive. You’ve done something great with your vision, with your startup, to create a category that’s attractive.

In this case for 43 companies to comment. And I love the knowledge that you dropped on us today. If you are in that situation on how to offset it, Stevie, thank you for taking the time to do that.

Stevie Case: Thank you for having me. It’s a been such a great opportunity and I’m grateful to have the chance to speak with you.

Mark Roberge: Today’s episode is written and produced by Matthew Brown. Our show is edited by Matthew Brown. Big thanks to HubSpot for Startups and to the HubSpot Podcast Network for keeping the audio on. Hey, also we’re a new show, so if you like what you hear, or if you hate what you hear, leave us a rating and review over on your favorite podcast player.

I love the feedback. Also, check out Stage 2 Capital. We’re the first VC firm running back by over CCOs. So if you’re an entrepreneur looking to scale your business, check out stage2. capital. All right, that’s it for today. I’m Mark Roberge. See you next week.

Source: https://youtu.be/sFnEc1l3VxY?list=PLxEk_-9hb_F9UpZHfacUr9N3YbjnuKabX