Preparing for Trump to Shift the Manufacturing Trade Environment

Industry Week

By Robert Schoenberger

Nov. 14, 2024

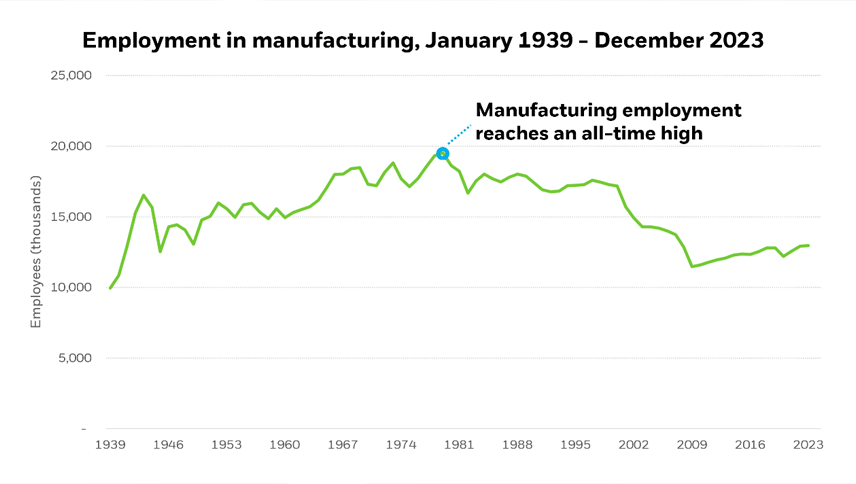

Jill Jusko: Hello and welcome to today’s Industry Week’s Production Pulse, how manufacturers can prepare now for more tariffs. I’m Jill Jesko, and I’m executive editor of Industry Week. So the U. S. presidential election is over, and what we know is that President elect Donald Trump will be returning to office very shortly.

We also know that he’s shown a willingness in the past to will tariffs as a trade tool. And we also know that he has been vocal about implementing new tariffs during his most recent campaign. Two examples of that are, uh, you know, we’ve heard anything from 10 to 20 percent tariffs on all Ford imports.

We’ve heard 60 percent on Chinese imports. Uh, those are two examples that he has. Uh, throw out thrown out, however, despite what we do know, there’s still a lot that we don’t know, um, what the outcome of the election truly means in terms of new tariffs and their impact on the supply chain and manufacturing likely will remain unclear in the short term.

Our goal in today’s Production Pulse is to discuss what U. S. manufacturers can do now to prepare for changes to trade and tariff policy in light of this uncertainty and whatever those changes might be. Joining me today to share some thoughts on the topic are Jeremy Tancredi, partner in West Monroe’s supply chain practice.

Dan Swartz, International Tax Services Principal at Crow, and Greg Houssissian, partner in the law firm Foley and Lardner. With that, thank you gentlemen, and we will go to Jeremy with our first question. And Jeremy, uh, you know, given that we don’t know a lot yet about when and how, you know, tariffs may be impacted by the new presidency, what can, what should, Manufacturers would be doing to prepare.

What should they be doing now?

Jeremy Tancredi: Yeah. Thank you, Jill. Um, I think the first thing that I would recommend and something we’re talking to our clients at West Monroe about is really just, uh, don’t take too hasty of actions right now. The thing I would recommend they do do is look at, take a hard look at their supplier base.

Um, you know, it’s, it’s fairly straightforward to think about your tier one suppliers who are going to be sourcing products directly from China or some of these other places. and plan accordingly with those sources. But what we’re telling them to do is really take a look at those tier two and tier three suppliers as well.

Um, any tariffs that impact those suppliers are going to filter back to the end manufacturer or consumer. So understanding where all your, even tier two and tier three sources are coming from is going to help you plan accordingly. And then you can take a look at potentially sourcing different suppliers from different areas.

that may not be as heavily impacted by the new tariffs.

Greg Husisian: Yeah, I would agree with all of that. With the Jeremy just said at this point, the key things to do are understanding and risk planning. Um, a key thing companies can do is pull your ace data, you know, from the customs portal and make sure you have a good understanding of what your tariff risk exposure is and from which countries, particularly with regard to China and Mexico.

Those two countries have to be at the top of the risk planning, first of all, because China is a bipartisan, um, source of, of angst. Nobody is really going to complain too much if, if, um, President Trump increases the China, uh, trade tariffs. And he’s already shown once that he could do it. And he has the authority under Section 301 To declare that China is not in accordance with its settlement for the less for be tariffs.

And so on day one, he could literally increase those imports. And then Mexico. Um, secondly, they’re a potential target because in 2026, the USMCA is up for reapproval. So that, um, makes that a potential source of higher tariffs, if even if it’s as part of a threat to achieve other goals, such as on, on immigration.

So it’s the first thing is to understand your, your risk exposure. And the second thing is to start risk planning, beginning with China and Mexico. And then also then after that, looking to see what your exposure is for the rest of the world.

Jill Jusko: Okay. And Dan, do we have Dan with us? It looks like we may have lost Dan.

Okay. We, if hopefully Dan will rejoin us, um, in the mean time.

I’m sorry, Jill. This is Robert Schoenberger, editor in chief here at industry week. Your audio just went out for a second. So if you could repeat that question, I’d appreciate it. Sorry.

Jill Jusko: Okay. Thank you, Robert. So the, the, what I wanted to ask you about is I have, um, heard some comments about, from manufacturers about.

Um, you know, what they should be doing in advance and are you telling anybody that they should be purchasing, moving up capital equipment purchases or, um, robust scenario planning? It sounds like that is some of what you said. Um, and it sounds also like you said, country of origin, you know, making sure you understand your country of origin is an important component.

Greg Husisian: We’re definitely seeing that for some of our clients. They’re trying to, um, see where they can get goods that they were planning to bring in, you know, maybe next year, get them into the country sooner. Anything that’s entered into the United States is obviously, um, immune to the, to the tariffs. People have already been in a multi year process of moving production out of China.

So we’re telling them. That’s that’s great because they’re they’re at the highest level of tariffs generally, but make certain you understand like the substantial transformation rules. And if you’re using the parts and components from there that you are doing it correctly, um, because, um, Customs has unprecedented ability to see into importing patterns now with with all the data being electronic, and they’re using that quite frequently and finding a lot of instances where people aren’t really doing enough in the third country because they’re using substantial parts and components from China.

Um, those efforts by customs are only going to go up if the tariffs from trying to go up, because that’s going to give people even more incentives to try to claim their products are from a different country. And, uh, that could lead to, you know, big, big bills for, for unexpected tariffs if customs disagrees with you on your tariff engineering strategies.

Jeremy Tancredi: Yeah. And I think to, to add on too, and to, to answer the question about, you know, large capital investments, that is the one area we are recommending potentially looking at for our clients. Uh, you know, we know there is uncertainty, but you know, we serve the upper mid market Fortune 1000 type of clients, so they don’t always have the largest capital line around for some of these major investments into manufacturing automation and things of that nature.

So any of those type instances where we may not be a hundred percent certain what the impact’s gonna be. But if that’s already in your plan for the future, do what you can expedite that as much as possible, uh, to avoid, you know, additional tariffs on top of that.

Jill Jusko: Okay. Terrific. Okay. Dan, would you like to, uh, share some of your thoughts on how manufacturers what they can do to prepare?

Um, not with this level of uncertainty that still is facing us.

Dan Swartz: Yeah, Jill. I think there’s two suggestions I have. I know everybody’s recommending things such as going back and looking at your tariff classifications. Looking at options for near shoring. But from our experience with the 2018 tariffs, I really recommend everybody who’s attending today’s, uh, meeting here is to find out who your customs broker, uh, or your bond broker is.

A lot of companies have no idea who has sold them their customs bond, yet this could be one of the most important relationships that you have as we go through this period of increasing tariffs. And the reason why is that your bond has a limit, and that limit is based upon the amount of duty that you accumulate during a 12 month period.

And as the tariffs increase, your bond limit’s going to have to follow. And as the bond limit climbs higher, The underwriters of the bond are now going to pay more scrutiny to your company. They’re going to be wanting to look at audited financial statements. And in many cases, they’re going to require that you put up collateral in the form of letter of credit.

So I’d recommend now is the time to reach out to your bond broker, start having a conversation with them instead of waiting until you start receiving insufficiency notices down the road. With everybody else and then trying to vie for some time, uh, from your bond broker. Also, if you’re in the market shopping for a bond broker, there are some really good ones out there.

They’re relationship oriented and that have good relationships with underwriters and that really hone in on those.

Jill Jusko: Okay. Terrific. So let’s move on to our next question. How about what shouldn’t manufacturers be doing at this time? And by that, I mean, Are there things that could just be a waste of their time doing it now, like too soon, before there is real clarity? And, um, you know, let’s go to Jeremy for that.

Jeremy Tancredi: Yeah, I think the thing that I am recommending to my clients that they do not do is, you know, don’t overreact at this moment.

Um, I’ve already had some clients who’ve already started purchasing materials in mass quantities to try to get ahead of it. And we’re really telling them that, you know, it might not be the best practice. You know, first and foremost, uh, it’s very disruptive to your manufacturing supply chain. You know, you’re having, you’re ordering larger quantities than normal, which then leads to storage issues in your warehouses.

It leads to manufacturing production plan issues and just a lot of excess inventory. Um, you know, that’s very costly, obviously. This is the second kind of effect we have on that is with already people reacting and buying more from overseas in anticipation of this taxes. What we’re already starting to see is transportation costs go up.

All the disruptions the last few years in supply chains, as this has happened, capacity for shipping containers, tractors and trailers in the U. S. here domestically, you know, when there’s those spikes, we see the prices surge. So even ordering ahead, any savings you could see getting ahead of some of these tariffs, you could be offsetting those by higher transportation costs.

So until there’s more clarity on certain areas and tariffs, Um, you know, we’re recommending for your, your everyday type of materials and ingredients to potentially hold off a little bit on those large pre orders.

Jill Jusko: So just to be clear, so you said they’re having a tendency to overreact. So are you telling them just to maintain the status quo at the moment, more or less?

Jeremy Tancredi: Yeah, I’m on certain materials that they use. They’re highly consumable that they have a lot of, um, that they order large quantities of because they’re going to be paying more a premium on the shipping containers and transportation costs right now because we are seeing that already starting to spike in anticipation of those tariffs.

So to save money on the tariffs, they’re just paying higher transportation costs. And it can end up being kind of a net, um, financially for their supply chains.

Jill Jusko: Okay. How about you, Dan? Anything you’re telling manufacturers or supply chain participants not to do at this point?

Dan Swartz: Well, we have a lot of experience from 2018 and what a lot of manufacturers did back then to get themselves into trouble.

Uh, If it’s too good to be true, it probably is. If you see companies advertising that they can take your cargo through an intermediate country and slap a made in Malaysia sticker on it, when it was actually produced in China, not a good route to go. Um, we also saw companies who were kidding product out of China into third countries, like the Philippines and doing simple assembly there.

But when you really look at the bill materials. Uh, it didn’t result in a substantial transformation of the goods. It still remained a product of China, uh, despite their best efforts. So my caution is this, there’s going to be a lot of people out there with differing ideas on how to try to navigate around the tariffs, be skeptical, look out for your company’s best interest.

And, uh, don’t take flyers on some of these ideas are just too good to be true.

Greg Husisian: Yeah, I would 100 percent agree with that. We’ve seen too many situations where people have either adopted like middleman pricing, um, which, which was kind of a hot topic when 301 came out saying that that could minimize the entered value and often they weren’t doing it.

According to customs rules or where they’ve just moved like kind of the final assembly of the product abroad Which customs is not going to buy as a substantial transformation because you’re not doing that much and not really in you’re taking inputs with a predetermined use. But stepping back, there’s, there’s kind of two import areas that are very important and you can’t lose sight of, of either of them.

One is the tariffs and how to cope with that. And in that section, people right now should be focusing on identifying their risk exposure, understanding the risk exposure and, and game planning. But the second piece, which they probably should be working on now is customs has a huge. Um, focus on supply chain integrity, um, particularly with regard to China, forced labor, human trafficking, U.

F. L. P. A. Things like that. And we’re seeing such a huge ramp up in customs, um, detentions for U. F. L. P. A. As well as forced labor that people should be looking at that as well, because that’s going to be wrapped up it, um, with it. Because again, there’s that bipartisan consensus that that China, it’s okay to beat up on China, and a lot of those concerns arise with that as well.

So, while people need to be thinking about how they’re going to cope with the higher tariffs, they also need to be coping with the reality of the supply chain integrity being a huge focus, and that can disrupt your operations even more, potentially, than the higher tariffs if your goods are being detained at the border.

Jill Jusko: Okay. Terrific. You know, I was thinking as you were talking, um, you know, we’re talking about coping with the tariffs. You know, is there an equal percentage of people that are just how do I avoid the tariffs? You know, um, altogether, what can I do to avoid, um, getting, getting tariffed? hit by the tariffs.

That’s probably part of some folks scenario planning, I would expect.

Greg Husisian: Yeah, I mean, usually that’s going to, well, first of all, we don’t know if the, if the tariffs go up, if there’s going to be an exclusion process and whether it will be a good exclusions process, because there’s a lot of problems with the section 301 process.

They were very difficult to come by and kind of random in terms of what was granted. Um, so that’s, that’s a big unknown, but in general. The biggest tariff savings whether it’s like for anti dumping duties or for tariffs going high on one country is to move out of that country and that means Understanding thoroughly the you know, the substantial transformation or the free trade agreement rules if they apply um as as as well, but you know, because the the goods basically the Tariff is determined by the value of the goods, plus the country of origin of goods, plus the classification.

Um, the classification and the entered value can be pretty much fixed by the reality of what they are, so that leaves kind of changing the, um, You know, the country, country of origin. And other than we know that China is going to be, um, in the crosshairs, we don’t quite know what’s going to happen to, um, other countries.

Maybe President Trump will decide to target countries. They have like a big trade surplus with the United States, which would include like Germany. Um, maybe, maybe he’s going to look at, at, at issues like that. We don’t know what’s coming in, but we do know that at the, um, Lighthizer is likely to be in charge of the trade policy again.

And this is a very experienced trade lawyer who, who knows all the levers that can be pulled and is strongly in favor of using tariffs as a way to protect us industry. So we know that something is going to be done because this occurred before it and president Trump views it as one of the big successes of his first administration.

Jill Jusko: Okay, great. I’m going to stick with you. Um, Uh, Greg, and then jump over to you, Dan, for, uh, I guess a logical follow up question. In terms of tariffs, what kind of hurdles Or steps does any president face and imposing new tariffs. And as I mentioned before, just doesn’t declare a tariff and it exists, do they?

Greg Husisian: Well, I would have agreed with you a few years ago because, um, under the tariff programs like Section 232 or 301 or, um, The the International Emergency Economic Powers Act, they all have conditions like it needs to be national security, um, or there needs to be an unfair trade practice like section 301.

But what we saw in the first Trump administration was that, um, you know, the president directed the USTR to basically find that there, that these, um, conditions were met. And when they were challenged at the court of international trade, the court of international trade was, was very, deferential. Um, and so those precedents would, would help as well, especially with regard to section 301, where there is, there was a settlement of the list four B tariffs that said that China would increase their imports from the United States by 200 billion, which they didn’t do.

So using that existing trade authority, President Trump could on day one Direct the USTR to find that they’re not in compliance and use that pre existing investigation to increase the China tariffs We also have the 2026 Um, renegotiation of U. S. M. C. A. That gives a lot of leeway there to potentially do things.

And the reality is, is even if the courts were to eventually say that President Trump was acting precipitously and didn’t have the authority to say increased tariffs across the board, we saw with the section 301 litigation that that takes years to work through. W. T. O. Challenges are even slower and our perspective only.

So by the time, um, you know, the courts would take action to potentially strike these things down. It could be 34 years in the future and President Trump is at the end of his term.

Jill Jusko: And Dan, would you like to weigh in on that?

Dan Swartz: Well, I agree with everything Greg said, and just would add that we’re only two years away from a midterm election. So whatever is imposed by president Trump, um, and even if Congress is involved here at some point as well, it may. Be temporarily. Um, so going back to your earlier question, Jill, what manufacturers can do today?

One of the other recommendations I would have is for them to reach out to their congressional delegation and invite them into your factory. Uh, let them know that you exist. Let them know how many people you employ in your area, how many downstream vendors, uh, you’re providing jobs to in your community.

Um, and let them know how important international trade is to your business. We did see rather large carve outs with section 301, uh, for certain companies and industries. Uh, so, you know, lobbying does go a long way up front, but on the back end, yeah, I expect that there’s going to be a lot of exclusions or exemptions available for companies.

Um, and so having a trusted advisor who’s helping you navigate around these exclusions and submitting petitions. It’s probably gonna be invaluable.

Jill Jusko: Okay. Does anybody have any last words before we wrap up today? Any final pieces of advice that they can share with our, our audience?

Greg Husisian: Uh, I would say if you haven’t done like a, a customs review or, or a supply chain check to be certain that you’re, you know, you’re up to speed. If you haven’t done, you know, something like that, maybe taking like 40 or 50 of your key, um, skews and, and be certain that you’re handling things properly.

This would be. a good time to do that. You not only may find that there’s areas where you’re underpaying your tariffs, but you may find that there’s tariff saving opportunities, like you could use duty drawback or FTCs or something like that. Um, getting your import position on the right posture with customs is important, not only because customs is using all that ACE data to, um, See if there’s issues and they’re reaching out to people shooting out those form 28th to see if people have problems, but it’s going to become even more important in a higher tariff environment because the potential loss to the company of overpaying your tariffs.

Um, we’ll become greater and the potential risk exposure from underpaying your tariffs and the potential penalties becomes much greater. So this this to me is a wake up call to say you need to be doing um, a check on on both your supply chain integrity and to be certain that you’re sourcing your materials ethically, so your goods don’t get detained.

But also to be, Doing some kind of, um, audit on your customs operations to be certain that your, your import posture is in good shape because in the end it’s the importer of record who’s responsible for any, um, shortfalls in compliance, not the customs broker, who’s just basically acting as your agent.

Jeremy Tancredi: Yeah, I, I agree with all that. And I would definitely double down on the, the notion to, to map your suppliers. You know, as I mentioned earlier, it’s, it’s easy to focus on your tier ones, but. Uh, if there’s tariffs on your tier two suppliers, tier three suppliers and components that go into some of your parts that you’re manufacturing, you know, that cost is going to be passed along somewhere.

So. Make sure that you’re fully aware of all that and what that impact has on your financial supply chain.

Jill Jusko: Okay, terrific. Okay. Sounds like good words to wrap up on. So with that, I would like to thank you Dan Swartz from Crow for participating. Thank you Greg Houssissian with Foley and Lardner and thank you Jeremy Tancredi with Met West Monroe.

And thank you all and Thank you also to our audience and everybody. Have a great remainder of your day.

Jeremy Tancredi: Thank you, Jill. Thank you.

Source: https://www.industryweek.com/leadership/video/55243068/preparing-for-trump-to-shift-the-manufacturing-trade-environment-production-pulse