Reshoring and Restoring U.S. Manufacturing

Advanced Manufacturing

By Param Singh

May 24, 2024

In 2020, the COVID-19 pandemic brought global manufacturing to a screeching halt. The disruption of production was the primary factor: A spiral of suppliers shutting down temporarily or permanently as employees and workers were called upon by business owners and government agencies to stay at home.

This, in turn, led to a significant disruption in production, resulting in interruptions across the complex global supply chain. Delivery delays increased costs and created uncertainty for manufacturers and logistic services providers, contributing to a breakdown in the supply chain on multiple levels.

U.S. manufacturers relying primarily on China-based suppliers were surprised when that nation went under a severe lockdown. China, the world’s largest manufacturing hub, no longer produced or fulfilled supply orders. Manufacturers in the United States had to seek alternatives for the components needed to assemble their products. Those who could source alternatively did so at a higher cost. They passed the additional cost on to the next level in the supply chain and eventually to the consumer. COVID exposed the unsustainability of exporting jobs and the complications created by not having local or regional supply chains. U.S. manufacturing businesses now face the challenge of shoring up or reshoring their suppliers.

This challenge is not new. Manufacturing jobs were leaving the U.S. long before COVID. The need to reduce costs and maintain profit margins has long meant that component manufacturing had to move to countries where labor was cheaper.

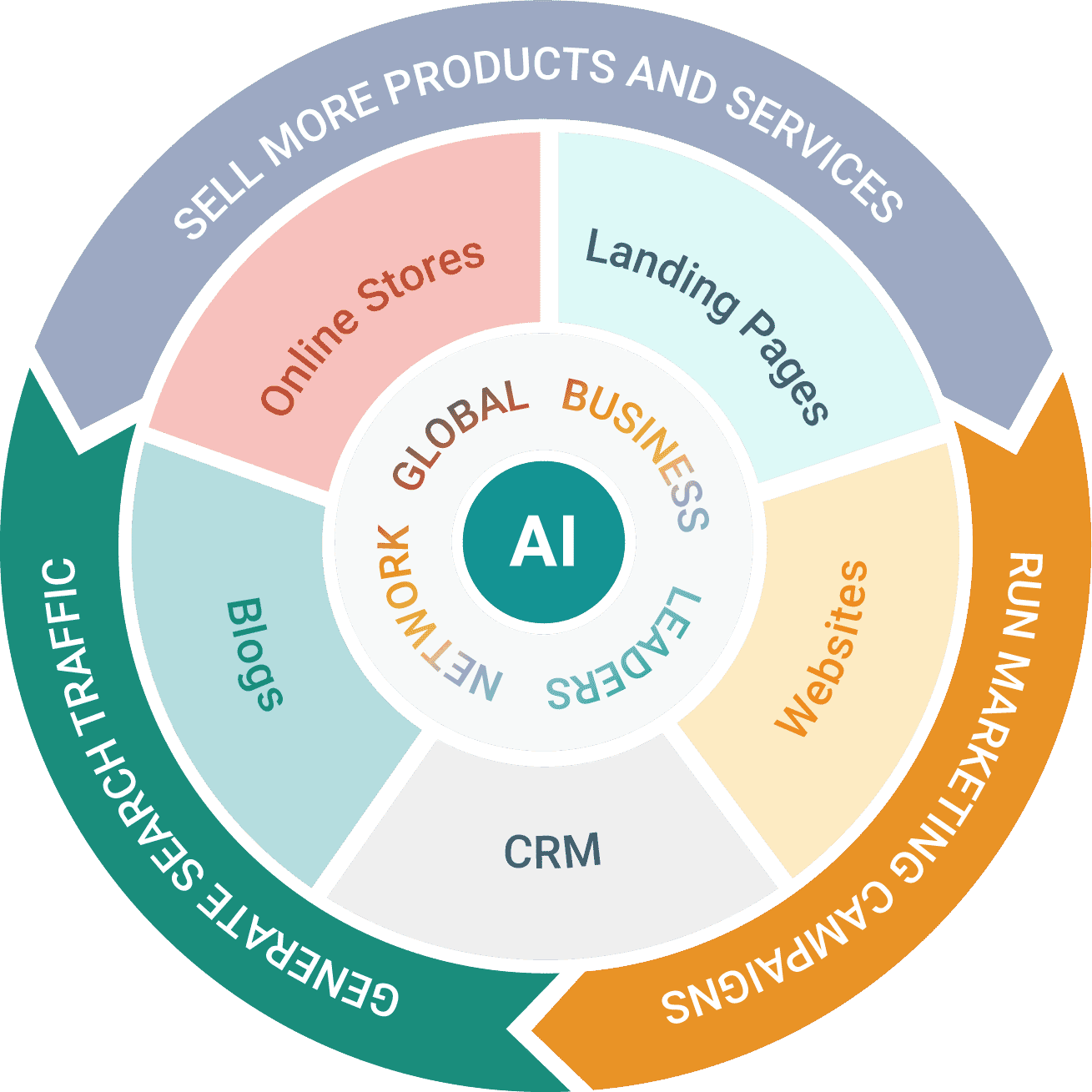

But there are ways for American manufacturers to confront this challenge, and many are already strategizing to meet it. Companies successfully reshoring their manufacturing capacities learned the importance of the combination of investment in automation and technology. The path to restoring a robust manufacturing sector back to the U.S. includes data analytics, machine learning, the Internet of Things (IoT) and artificial intelligence (AI), all of which provide greater access to cheaper capital along with government incentives to encourage capital investment.

Strategies to Bring Manufacturing Back

Managing complex supply chains requires planning, effective communication, collaboration and risk management, regardless of the location of suppliers. As they work to bring manufacturing back home, U.S. companies must ensure transparency and visibility throughout the supply chain, enabling them to monitor and track the movement of components and address potential bottlenecks or disruptions effectively.

To accomplish this, manufacturers need to consider implementing a combination of the following strategies as a way to re-establish a robust manufacturing sector in the U.S.:

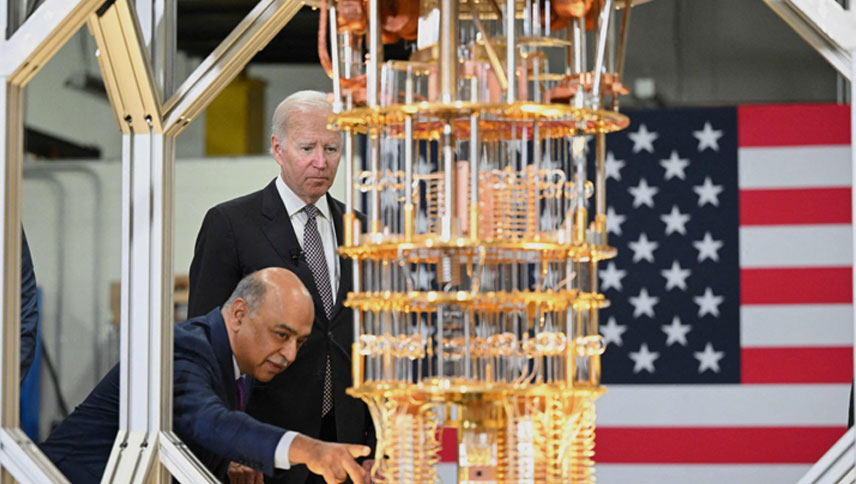

Establish a new focus on automation, IoT and the rapidly advancing field of AI. This strategy is foundational to improving efficiency, reducing costs and making U.S. manufacturing economically viable. Currently available and emerging digital tools will enhance production capacity and production rates, reduce the cost of labor and reduce exposure to volatility in labor availability. Telecommunications companies in the U.S. are already offering solutions to businesses for automation, increased connectivity and productivity. For example, implementing connectivity through the Industrial Internet of Things (IIoT) can enable real-time monitoring and control of operations.

Embrace advanced manufacturing technologies, such as additive manufacturing, advanced materials, augmented reality (AR) and digital twins. These technologies will increase efficiency, save money and create new job categories.

Implement data analytics and connectivity to improve decision-making and efficiency. Manufacturers can gain insights to optimize processes, predict maintenance needs and reduce downtime by collecting and analyzing data from sensors, machines and other sources.

Enhance workforce skills and create new categories of jobs. While technology is essential, the human part of the equation is still critical for advancement. Implementing these strategies will require upskilling and reskilling the current manufacturing workforce. According to the National Association of Manufacturers, many domestic manufacturers need more skilled workers. Companies can leverage incentives and invest in training programs, partnerships with educational institutions and apprenticeship initiatives to develop a skilled workforce.

Using Incentives

The U.S. government is significantly investing in incentives to bring manufacturing back stateside. These initiatives include financing domestic manufacturing, expanding access to capital for small manufacturers and maintaining technological leadership.

Targeted incentives that address the core problems should be encouraged. For example, electric vehicle tax credits promote cars assembled in North America, enabling a lithium-ion battery supply chain in the U.S.

The downside is that such incentives tend to benefit large corporations rather than the small- and medium-sized enterprises (SMEs) that are the backbone of U.S. manufacturing. The government can offer similar tax credits to SMEs that invest a certain percentage of revenue to upskilling their employees. Additionally, changing investment regulations can make the availability of capital easier and less expensive for companies that reshore production.

What Does the Future Hold?

There is both good and bad news. While more meaningful government incentives are needed, companies, especially SMEs, must use those currently available. Major companies such as General Motors, GE Appliances, Intel, U.S. Steel and Lockheed Martin are all investing significant money in new manufacturing facilities. Walmart previously announced a $350 billion investment to make U.S. manufacturing more “affordable and feasible,” and General Electric plans to invest $450 million in its manufacturing facilities.

At the same time, however, as these companies invest in a domestic manufacturing future, American imports from low-cost labor markets—led by Vietnam—have increased. The outlook for bringing manufacturing back to North America is mixed. While COVID created numerous hardships, the disruption of the pandemic also motivated many companies to strengthen their supply chains and move suppliers from China. Some were reshored to North America to make the availability of manufacturing inputs more stable and sustainable.

Though much depends on federal and state governments and manufacturers, the future can be brighter. It will require rethinking government incentives to include support for small- and medium-sized manufacturers to produce in the U.S., especially when it requires significant investments in automation, AI and other new technologies to restore a vibrant manufacturing economy.

Source: https://www.advancedmanufacturing.org/leadership-innovation/reshoring-and-restoring-u-s-manufacturing/article_28463de2-1a07-11ef-964d-db2330d7113d.html