The Theme of Reshoring – EXPLAINED Video

iShares

Hi, this is Tony DeSpirito, Global CIO of Fundamental Equities, and I want to tell you about one of the investment themes that I’m most excited about for the second half of 2024. And that’s the theme of reshoring.

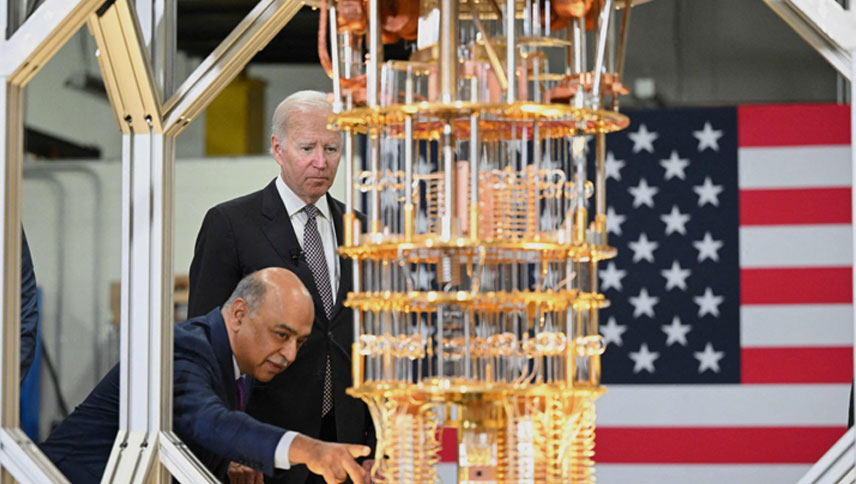

So, what is reshoring? Reshoring is basically bringing production back to the end market, where the sales occur. So, in the case of the United States, it’s about bringing production back to the U.S. and to our NAFTA partners in Canada and Mexico. And this is going to impact a wide swath of industries. It’s going to impact semiconductors, where companies are building new chip plants in the United States to take advantage of the Chips act. It’s going to affect industries such as autos, where companies are moving production back to the U.S. and Mexico, particularly with respect to electric vehicles. And it’s even impacting an industry like health care, where there were shortages of certain generic drugs during Covid 19.

When you think about reshoring, it’s really about reducing risk. It’s about building resilience in your supply chain. It’s about reducing the risk of supply shortages. It’s about reducing the risk of tariffs. It’s about reducing political risks, etc. And so, we’re particularly excited about being able to implement on this strategy in an active way. So, we can take advantage of whatever price movements and supply and demand movements happen as this economic change occurs.

Thanks for listening.